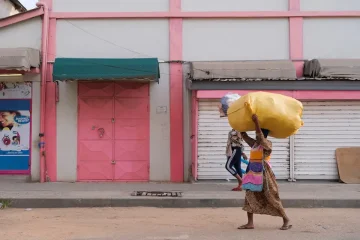

ANGE ABOA

COCAO exporters in the world’s top grower Ivory Coast are switching to cheaper contracts for later delivery and buying less to cut inventories amid a glut, blaming a scheme to charge a $400-per-tonne cocoa premium to curb farmer poverty.

Exporters said that the introduction this season of the Living Income Differential (LID) premium – paid by exporters to the government to support farmers – together with a bumper crop while global demand is falling, had left them with tonnes of unsold stocks and forced them to limit risks.

“You have to adapt or lose a lot of money on LID,” a director of an Abidjan-based international cocoa company said, requesting to remain anonymous because of the sensitivity of the issue.

“We all followed the market that switched to January-March contracts that were cheaper than the October-December delivery,” the director said.

Only Ivory Coast and Ghana, which together account for 60% of global output of cocoa, have implemented the LID, pushing up their prices relative to competitors.

Prior to the implementation of the LID scheme, beans in Ivory Coast were purchased and exported according to a defined period. October-December, and January-March for the main crop harvest, and April-June, July-September, for the smaller mid-crop harvest.

Exporters said most of the cocoa purchased between October and December will now be used to honour around 80% of the January-March contracts, adding most of the 400,000 tonnes of beans harvested in the January-March period will end up unsold.

The move by the exporters has left regulator Ivory Coast Coffee and Cocoa Council (CCC) with tonnes of unsold beans from the main crop harvest. The volume of unsold main-crop beans in farm warehouses could reach 200,000 tonnes by the end of January, sources have said.

Another Abidjan-based director of a European cocoa trading firm, who also requested anonymity, said that contracts for delivery further out in the year now represent over 70% of the company’s portfolio this season compared to 30-40% previously.

Buyers including chocolate majors have also reached their targeted volumes for the main harvest and no longer plan to buy more than necessary.

“With the introduction of LID, it is no longer profitable to hold inventory like before. We just buy what we need,” the director said. Exporters expect the trend to continue into the 2021/2022 season.

Their decision is having repercussions further down the chain with middlemen and cooperatives unable to finance purchases from farmers who are offering beans from the main crop at a steep discount to the guaranteed farmgate price.

“Let’s say that 70% of the volume of beans that is usually produced between January and March is going to stay in the bush with the cooperatives or the farmers due to a lack of buyers,” said a purchasing manager for a major exporter based in the port city of San Pedro.