SETH ONYANGO, BIRD STORY AGENCY

SOUTH African citrus farmers are finding alternative markets for 10 per cent of the shipment to Russia that decelerated following its military offensive against Ukraine.

Justin Chadwick, CEO of the Citrus Growers Association of Southern Africa (CGA) told Reuters the UK, Middle East and South-East Asia were taking up the surplus.

“Since then, the UK’s share of soft citrus has increased from 24 per cent to 61 per cent, at the expense of Russia decreasing from 32 per cent to 5 per cent,” he said, highlighting how markets in Africa can adjust to geopolitical and supply chain shocks.

According to CGA data, SA’s total citrus exports to Russia dipped 70 per cent after Western capitals sanctioned Moscow over its military operation in Ukraine.

Shipping firms like Danish giant, Maersk, halted vessel operations in Russia and Belarus.

Increased shipments of citrus into the UK, Asia and the Middle East provided a critical buffer for the industry that employs over 120,000 workers in SA.

It will ensure, for now, that the fruits which do not enjoy longer shelf life do not go to waste.

According to the US Department of Agriculture, favourable weather conditions, new areas under production, and higher demand in premium markets, such as the US, are driving the growth of SA’s citrus exports.

“Duty-free exports of citrus to the United States under the African Growth Opportunity Act reached a historic high of 100,234 MT in 2021,” said the Department.

“However, several challenges are facing the industry, including, soaring input costs, especially fuel and fertilizer, a major surge in shipping costs, ongoing operational challenges at the country’s ports, and the impact of the Russia-Ukraine conflict on established trading patterns.”

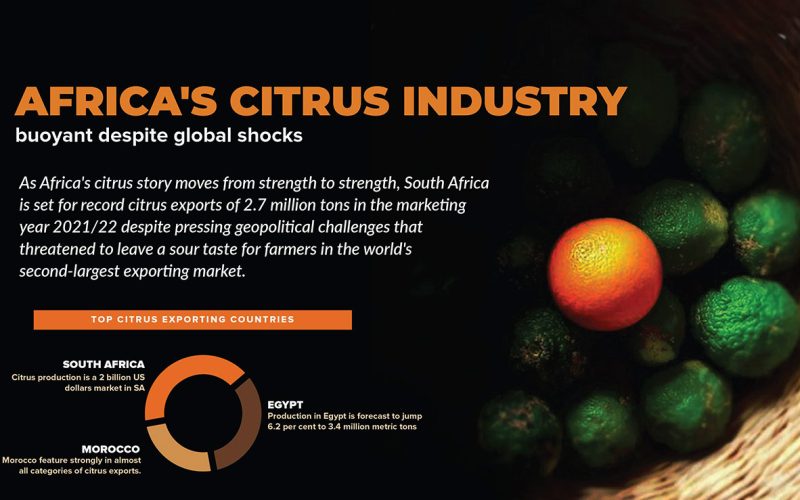

SA is the world’s second-largest exporter of citrus after Spain and plays a major role in Africa’s increasingly dominant role in the global trade of orange, tangerine, lemon and grapefruit. Citrus production is a 2 billion US dollars market in SA, behind Spain with 4 billion US dollars.

Egypt, Morocco and South Africa feature strongly in almost all categories of citrus exports, including oranges, mandarins, lemons and grapefruit.

The three countries are regularly measured against EU, USA and other world export figures, individually rather than as a block.

With many smaller African countries also boosting citrus production, African exports, taken as a whole, look set to dominate the world citrus trade for years to come.

This is especially true in the export market for oranges. Exports of oranges from Africa are expected to continue to grow significantly, due to increased acreage and favourable weather conditions in citrus-growing African states, according to key trade and agriculture sources.

Production in Egypt is forecast to jump 6.2 per cent to 3.4 million metric tons while South Africa will record a 3 per cent increase to 1.7 million metric tons, according to the United States Department of Agriculture (USDA).

In the reporting period, the Egyptian Foreign Agriculture Service (FAS) projects the total planted area in oranges at 168,000 hectares.

This positioned the North African state as the world’s largest exporter of oranges by volume at 1.5 million metric tons, surpassing rivals Spain and South Africa, though these two countries still rake in more revenue from their orange exports.

Oranges make Egypt around 1 billion US dollars in export revenue a year, a figure that has been growing at a pace of 17 per cent annually since 2017, according to data from the country’s Agriculture Export Council.

In South Africa — the biggest revenue earner in Africa from orange exports — the CGA estimated the country will ship 158.7 million cartons of fruit in 2021.

According to Tye Fresh Fruit Portal, South Africa exported 146 million cartons in 2020, and 130 million cartons in 2019, meaning the 2021 season could see 22 per cent export growth in just two years.

“Eswatini and Zimbabwe combined have also increased their export figures from 3.9 million cartons in 2020, to an estimated 4.4 million cartons in 2021 – an increase of 13 per cent, bringing the total Southern African volume to be exported to more than 163 million cartons,” the CGA said on its website.

According to Produce Report, exports of soft citrus (which covers mandarins) are estimated to increase by 29 per cent in 2021, up to 30.5 million cartons. Exports of late mandarins are projected to grow by 42 per cent this year, the largest of all soft citrus varieties produced in South Africa, the site said.