SETH ONYANGO

MORE Africans are accessing mainstream financial services thanks to rapid growth in mobile money services on the continent.

Markets such as Kenya and Nigeria are leading in the development of innovative products tailored for the historically underserved demographics by the formal financial sector.

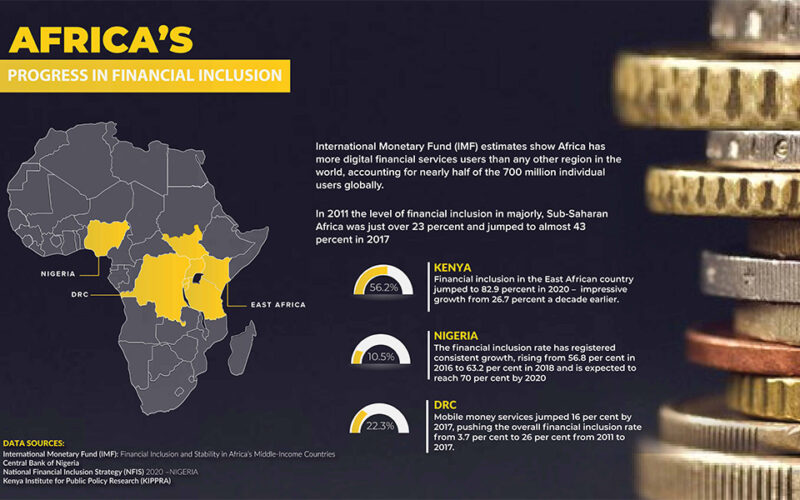

International Monetary Fund (IMF) estimates show Africa has more digital financial services users than any other region in the world, accounting for nearly half of the 700 million individual users globally.

In 2011 the level of financial inclusion in Sub-Saharan Africa was just over 23 percent and jumped to almost 43 percent in 2017, buoyed by the growth of digital financial services. The figure is expected to be much higher today.

According to African Development Bank (AfDB), financial inclusion has grown dramatically in recent years, as seen in the number of countries that committed to the Maya Declaration and the G-20 Financial Inclusion Action Plan, as well as strategies and targets set by individual governments.

But the level of growth varies widely, according to the UN.

“For example, the ambition that 50 per cent of Africans would use mobile money in 2022 had already been achieved in Kenya, where 73 per cent of people already use it,” former UNCTAD Secretary-General Mukhisa Kituyi asserts.

“The laggard states in Africa need peer pressure and exposure to best practice.”

The Kenya Economic Report 2020, conducted by the Kenya Institute for Public Policy Research and Analysis (Kippra), for example, shows that financial inclusion in the East African country jumped to 82.9 percent in 2020 – an impressive growth from 26.7 percent a decade earlier.

In Nigeria – a country with an estimated population of over 211 million as of 2021, the financial inclusion rate has registered consistent growth, rising from 56.8 per cent in 2016 to 63.2 per cent in 2018 and is expected to reach 70 per cent by 2020.

In the Democratic Republic of Congo, mobile money services jumped 16 per cent by 2017, pushing the overall financial inclusion rate from 3.7 per cent to 26 per cent from 2011 to 2017.

Still, Africa’s unbanked population remains huge with an estimated 350 million adults lacking an account, 63 million of which are Nigerian. In Ethiopia, 60 per cent of its adult population, about 70 per cent of the DRC’s adult, and two-thirds of Egypt’s adult population did not have a bank account in 2017.

At 43 per cent bank accounts penetration, Africa lags behind the 69 per cent global average and the 63 per cent developing world average.

But with the anticipated new data, Africa is projected to jump over the 50 per cent mark by end of 2022 according to UN estimates.

This is credited to the increasing availability of the internet as well as flexible regulatory rules offered to fintech and financial institutions in those countries.

Financial inclusion is defined as having the access to useful and affordable financial products and services that meet the needs of individuals and businesses alike through transactions, payments, savings, credit and insurance in a responsible and sustainable manner.