MOZAMBIQUE, pinning its hopes on vast natural gas reserves to drive sustainable economic development, has created a national investment savings fund called the Mozambique Sovereign Fund.

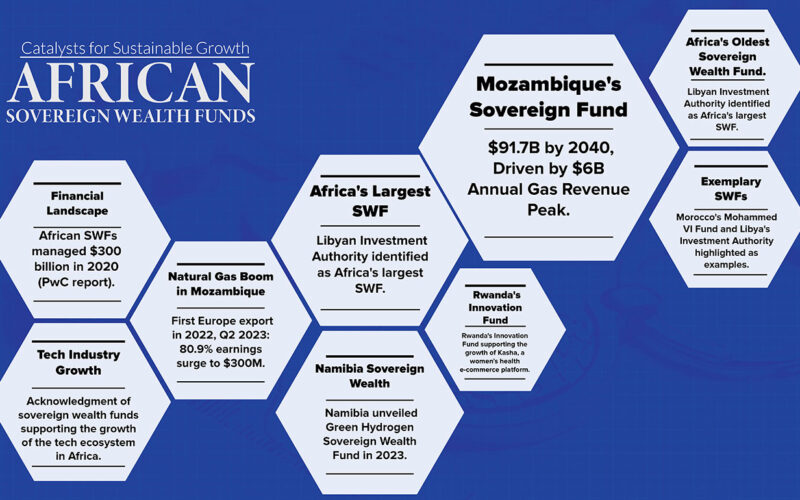

According to Reuters, the country’s parliament last month approved the fund’s establishment, anticipating it to accumulate up to US $91.7 billion by 2040.

In an interview with news platform 360 Mozambique, Max Tonela, the Minister of Economy and Finance, highlighted that revenues from natural gas “will peak in the 2040s at more than 6 billion dollars a year.”

Mozambique exported its first natural gas cargo to Europe in 2022 from the Coral Sul floating unit at Area 4 of the Rovuma Basin.

Revenues from natural gas exports have seen a substantial increase, with Q2 2023 data from the Bank of Mozambique reporting earnings of US$300 million — a notable 80.9% surge compared to the same period in 2022.

The momentum continues with ongoing projects, including the Coral North floating natural gas project by a consortium led by Eni. LNG Industry, a global news site reporting on LNG projects, has said the Coral Sul North facility could be operational by 2027, producing an annual supply of 3.5 million tons of natural gas for exports.

The Rovuma basin off the coast of Cabo Delgado, another significant natural gas project, is expected to become one of the world’s largest upon completion, LNG Industry said.

In setting up the sovereign wealth fund, Mozambique joins a growing list of African nations creating dedicated investment funds sustained by natural resource revenues.

Namibia in 2023 unveiled the Green Hydrogen Sovereign Wealth Fund, collaborating with Dutch firms to expedite green hydrogen investments worth US$1.1 billion and sovereign wealth funds are gaining traction across Africa.

More than 20 such funds have been identified by the African Development Fund. Most rely on revenue from natural resources like oil, minerals, and natural gas.

According to Mohamed Benchaâboun, director general of Morocco’s Mohammed VI Fund for Investment, sovereign wealth funds are crucial because they serve as “vehicles that speak the language of the private sector while working to the priorities of the public sector.”

The Mohammed VI Fund is Morocco’s sovereign wealth fund, created by King Mohammed VI in 2022 to boost public investments as part of the economic recovery plan created in 2020. US $1.5 billion was injected into the Mohammed IV Fund during its launch.

According to the Global SWF Data platform, the Libyan Investment Authority is Africa’s biggest sovereign wealth fund (SWF), while Botswana’s Pula Fund is the continent’s oldest.

Emphasising the importance of private and government collaboration in building the funds, Benchaâboun stated during the Africa Investment Forum (AIF) in Marrakech, in November 2023, that invested funds need to come from both sectors.

“For each dollar invested by the Fund, a minimum of two dollars must come from private investors,” he said.

Yan Kwizera, a Rwandan investment and entrepreneurial consultant, underscores the potential for well-managed wealth funds to provide funding, resources, and expertise that could revamp key sectors.

He highlights notable examples of the positive impact of SWFs, such as the Rwanda Innovation Fund, a sovereign fund that supported the expansion of Kasha, a Rwanda-based e-commerce platform specializing in women’s health and personal care products.

A PwC report indicates that African SWFs managed US$300 billion in 2020, representing a substantial source of investible capital for the continent.

“As the tech industry in Africa continues to gain momentum, there is a growing need for investment capital to fuel its growth… Sovereign wealth funds can support the growth of the tech ecosystem,” Kwizera explained.