SETH ONYANGO, BIRD NEWSROOM

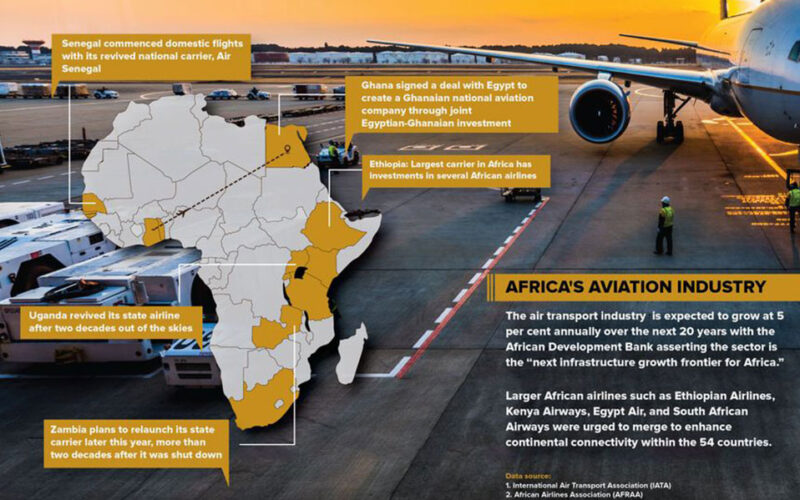

The air transport industry in Africa is expected to grow at 5 per cent annually over the next 20 years with the African Development Bank asserting the sector is the “next infrastructure growth frontier for Africa”

Africa’s aviation industry is expected to maintain a cruising altitude of 5 per cent growth per annum for the next 20 years, despite the ongoing COVID-19 financial turbulence. However, there is room for a far more aggressive takeoff.

International Air Transport Association (IATA) forecasts the sector’s growth to remain steady for two decades as African carriers add more routes on the continent, ink codeshare agreements and merge or acquire struggling airlines.

IATA further estimates that Africa’s planes will fly about 274 million air passengers by 2036.

This comes as African countries ramp up investment in their struggling or defunct national carriers, seen as a strategic marketing tool to bolster tourism.

In August 2019, Uganda revived its state airline after two decades out of the skies, with other countries shelling millions of dollars to either resurrect or expand their fleet and routes.

Ghana, which has been without a state airline since the collapse of Ghana International Airways in 2010, signed a deal with Egypt to create a Ghanaian national aviation company through joint Egyptian-Ghanaian investment.

In a similar deal, Zambia plans to relaunch its state carrier later this year, more than two decades after it was shut down.

In 2018, Senegal commenced domestic flights with its revived national carrier, Air Senegal, while Tanzania announced plans to buy new Airbus jets that will be deployed to fly new routes.

Meanwhile, Rwanda, Togo, and Kenya have also ramped up investment in their national carriers, despite Kenya Airways making unprecedented losses.

Last year, a few African countries mooted the merger of their national carriers at a conference in Nairobi, as part of economies of scale to make them competitive in the global market.

According to Business Daily, the talks also included eliminating visa fees within the continent, simplifying immigration rules, improving air connectivity infrastructure, and making airport charges affordable within Africa’s 54 countries.

To bolster Africa free trade and promote a tourism sector that is reeling from COVID-19 pandemic, larger African airlines such as Ethiopian Airlines, Kenya Airways, Egypt Air, and South African Airways were urged to merge and form the best continental airline, build intra-African routes and networks to enhance continental connectivity within the 54 countries.

Last year, carriers based in Africa lost 10.21 billion US dollars. However, those losses are far lower than the amounts that operators in other regions lost.

For instance, the world’s six largest airline groups lost 110 billion US dollars between them by November, according to the aviation news portal, Simple Flying.

But even as Africa’s aviation industry gains altitude, the high taxes and tariffs have been stymying growth and more rapid expansion – and, arguably, holding back regional trade – for decades, largely remain intact, making Africa one of the most expensive regions in the world in which to travel by air.

The latest African Airlines Association (AFRAA) Taxes, Fees and Charges in Africa report shows that passengers travelling within Africa from Kenya pay 50 US dollars in taxes and fees – more than the amount paid in Europe, which is 30.23 US dollars and the Middle East, at 29.65 US dollars. The average amount across Africa is 64 US dollars

Niamey, at 162.7 US dollars, Monrovia, at 145 US dollars, Bissau, at 137.9 US dollars, Dakar at 116.9 US dollars, and Doula at 115.6 US dollars are some of the costly cities for air travel, in terms of taxes and fees.

Industry experts attribute high airfare costs in Africa to a convergence of multiple factors including the cost of goods sold, intermediary costs, government taxes, regulatory charges, time of purchase (early-bird options tend to be cheaper), fuel costs, market forces of demand, and supply, and costs related to original equipment manufacturers.

Nonetheless, to ensure affordable air transport as well as traffic on the continent, AFRAA advocates the lowering of taxes that eat into airline operations.