[tta_listen_btn listen_text=”Audio” pause_text=”Pause” resume_text=”Resume” replay_text=”Replay”]

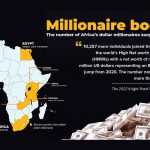

SMALLER African nations are giving rise to a new generation of millionaires, challenging the ‘big five” wealth markets on the continent – South Africa, Egypt, Nigeria, Kenya, and Morocco – some of which have experienced millionaire “flight” over the past decade.

According to the latest Africa Wealth Report published by Henley & Partners and New World Wealth, the growth of high-net-worth individuals in traditional powerhouse economies like South Africa, Egypt, and Nigeria is cooling off.

In contrast, emerging markets such as Rwanda, Cote d’Ivoire, and Zambia are experiencing a surge in their millionaire populations, indicating a shift in wealth generation across the continent. This comes as overall numbers of wealthy individuals dipped in the last ten years.

“Total high-net-worth individual numbers in Africa have fallen by 12% over the past decade (2012 to 2022),” reads the report in part.

“Rwanda was the top performing market in Africa during the period, with millionaire growth of 72%, followed by Mauritius, Ethiopia and Ghana, whose millionaire populations had been growing rapidly until 2019, have struggled over the past few years, which has pulled back their 10-year growth rates.”

This shift in wealth distribution highlights the potential of these emerging economies to reshape Africa’s financial landscape and comes despite the top five economies still controlling the bulk of the wealth.

“The ‘Big 5’ wealth markets in Africa — South Africa, Egypt, Nigeria, Kenya, and Morocco — together account for 56% of Africa’s high-net-worth individuals and over 90% of the continent’s billionaires.”

South Africa leads the ranking of the top 10 most affluent African nations in terms of resident high-net-worth individuals, significantly outpacing its competitors.

The Rainbow Nation was home to 37 800 US dollar millionaires, of a continental total of 138,000, at the end of 2022, according to the report.

It also boasts four of Africa’s wealthiest cities, with Johannesburg, topping the list, home to 14,600 millionaires.

“South Africa’s high centi-millionaire count is particularly notable. Centi-millionaires are typically the founders of large multi-national companies, making their presence in a country particularly valuable when it comes to creating employment,” the Wealth Report says.

Cairo comes in second place, followed by Cape Town with 7,400 and 7,200 resident HNWIs, respectively.

Lagos and Nairobi take the fourth and fifth positions, while Durban and Pretoria secure the sixth and eighth spots, with 3,600 and 2,400 millionaires, respectively.

Mauritius’ impressive stand in the rankings is quite striking, considering its modest geographical expanse and population size.

Africa’s millionaire population is expected to grow by 42%, reaching 195,000 by 2032. Mauritius leads the pack with a forecast 75% growth rate.

Meanwhile, countries like Namibia, Rwanda, Zambia, Seychelles, the Democratic Republic of the Congo, and Morocco are expected to see high-net-worth individual growth exceeding 60%.

Despite this growth, approximately 18,500 HNWIs left Africa between 2012 and 2022, with most relocating to the UK, the USA, and the UAE. Others have moved to Australia, Canada, France, Israel, Monaco, New Zealand, Portugal, and Switzerland.

Within Africa, most HNWIs have relocated to Mauritius and South Africa.

However, many African-born billionaires have left the continent in the past 20 years. With only 23 of the 52 African-born billionaires still residing in Africa, Henley & Partners assert this poses a significant challenge as these entrepreneurs have the potential to create substantial employment in their host countries.

“They usually relocate to expand their businesses or due to safety concerns,” the firm said.

Africa currently holds a total of US$2.4 trillion in investable wealth.

Of the 138,000 millionaires residing on the continent, each with a net worth of US$1 million or more, there were 328 individuals classified as centi-millionaires, having a net worth of US$100 million or more, and a further 23 billionaires each possessing a net worth of US$1 billion or more.

Wealth managers and private banks hold around US$150 billion of Africa’s high-net-worth individuals’ wealth.

Generally, wealth managers in Africa serve clients with investable assets over US$500,000, providing services such as asset management, financial planning, and inheritance planning, which remain in high demand.

Johannesburg in South Africa is the top wealth management hub in Africa, with the African wealth management market is set to expand by an impressive 60% over the next decade, according to the report.