[tta_listen_btn listen_text=”Audio” pause_text=”Pause” resume_text=”Resume” replay_text=”Replay”]

AFREXIMBANK is set to expand a local currency trade initiative, the Pan-African Payments and Settlement System or PAPSS, beyond its early adopters in order to provide greater financial autonomy to African traders.

This follows the successful pilot of PAPSS, billed as a project to advance intra-continental commerce transactions in local currencies, in nine countries.

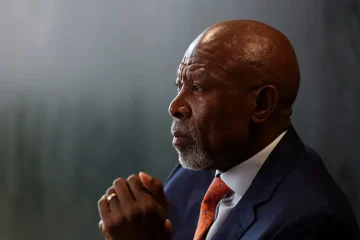

Afreximbank President Benedict Oramah, speaking at the 30th anniversary of Afreximbank in Accra, announced that the roll-out of PAPSS would enable the conversion of all African and Caribbean currencies on the continent.

“Very soon, we will be able to domesticate all intra-Africa payments and extend the same to CARICOM,” he said.

“Today the pan-African payments and settlement system is up and running, which will save the continent 5 billion dollars in intra-Africa transfer chains. It would also expedite and enable payment for intra-Africa trade in African currencies.”

“It is now possible for a Gambian to buy Nigeria’s urea fertilisers using Gambian dalasi to purchase naira,” Oramah added.

His sentiments come just a week after Kenya’s President William Ruto told the Djibouti parliament the time was ripe for local currencies to take centre stage in intra-Africa trade.

“Traders from Djibouti selling to Kenya or traders from Kenya selling to Djibouti, have to look for US dollars. How is US dollars part of the trade between Djibouti and Kenya? Why?” he posed.

“We are not against the US dollar. We just want to trade more freely. Let us pay in US dollars what we are buying from the US. But what we are buying from Djibouti, let’s use local currency.”

In March, Kenya announced that domestic oil firms will now remit payments for imported oil via a government-to-government transaction using the local currency.

The move was meant to alleviate the continual strain on the weakening Kenyan shilling against the greenback amid claims of hoarding.

Davies Chirchir, its Energy and Petroleum Cabinet Secretary, said the Kenyan government had inked a deal with Saudi Aramco and the Abu Dhabi National Oil Company (Adnoc).

Under this agreement, Saudi Aramco will provide Kenya with diesel and super for the next six months. Concurrently, Adnoc is set to supply three shipments of super petrol each month.

It is just one of the recent efforts by an African state to circumvent crippling local shortages of US dollars.

And as the world inches closer to the upcoming BRICS (Brazil, Russia, India, China, South Africa) Summit scheduled for August in South Africa, the issue of trading in national currencies is poised to take centre stage.

Joel Sibusiso Ndebele, the South African High Commissioner to India, recently lambasted the disproportionate influence of the US dollar, stating that such hegemony is not conducive to the growth and prosperity of emerging economies.

The African Continental Free Trade Area (AFCFTA), which boasts a colossal market worth US$3 trillion, offers an expansive platform for African nations to explore currency options for continental trade, potentially enhancing the local appeal of and demand for their indigenous goods and services. An increase in exports to continental partners could also significantly bolster their currencies.