EGYPT has seen hundreds of millions of dollars leave its treasury markets since the Russian invasion of Ukraine last week as investors flee emerging markets for safer pastures, two bankers with knowledge of the matter said.

Even before the crisis, Egypt had been working to sustain appetite for its treasury bills to plug current account and budget deficits and fend off pressure to let its currency weaken ahead of possible U.S. Federal Reserve rate hikes starting this month.

A moderate sell-off of Egyptian treasuries that began on Thursday gained momentum when European markets opened on Monday, according to the bankers, who declined to be named due to the sensitivity of the matter.

One said a few hundred million dollars flowed out of the secondary market on Monday and that yields on Egyptian pound denominated treasuries had jumped by 30-40% on average.

The other estimated that foreign investors had pulled $3 billion out of Egypt since Thursday, basing the estimate on the higher yields, increased interbank currency market activity and information gleaned from other banks.

After this initial surge, the market was relatively calm on Tuesday and Wednesday, the two bankers said.

The Egyptian central bank did not immediately respond to a request for comment on an exodus of dollars from the country.

Many investors are concerned that emerging markets may be more susceptible to any shockwaves resulting from the disruption of trade with Russia, including the resulting increase in some commodity prices.

Indeed, compounding Egypt’s economic headache is the threat of the Ukraine crisis driving up the price of imported wheat.

Russia and Ukraine accounted for around 80% of Egypt’s wheat imports in 2021, data from traders shows. The state grains buyer on Monday cancelled a second international wheat tender in four days as the crisis pushed prices higher.

$20 BILLION IN BILLS

Since November 2020 the central bank has kept its overnight interest rates unchanged, and the Egyptian pound has held virtually steady at around 15.70 against the dollar, helping maintain a picture of strength burnished by the economy staying in growth during the COVID-19 pandemic.

As of the end of December, foreigners held 321.8 billion Egyptian pounds ($20.55 billion) in treasury bills of up to one year and an undisclosed amount in longer maturities, according to central bank data.

“These inflows from portfolio investors (have been) going into the local currency market, and that has financed the current account deficit,” Renaissance Capital economist Yvonne Mhango told journalists on a conference call.

Egypt’s current account deficit rose to $4 billion in the July-Sept quarter from $2.8 billion a year earlier, official data shows, fuelled by a rising import bill.

“So, as you can imagine, one risk or concern is what happens if those flows do slow down,” Mhango said in comments made before the Russian invasion of Ukraine.

PRESSURE ON THE POUND

Bankers and analysts say a steep fall-off in net foreign assets (NFAs) in Egypt’s banking system shows how the strain on the exchange rate has been building.

NFAs dropped to 11.8 billion pounds in January, down from 186.3 billion at the end of September and hitting their lowest level since April 2017, according to central bank data.

Other signs of pressure include a sharp increase in central bank auctions of short-term deposits to local banks through open market operations, bankers say. These have risen by 360 billion Egyptian pounds ($23 billion) since early October to 985.35 billion pounds as of March 1, central bank data shows.

The operations are designed in part to soak up liquidity in the market to tamp down inflation, but also serve to dissuade local banks from crowding out foreign investors – and the foreign currency they bring – from the treasury bill market, many bankers say.

Any increase in Fed rates would likely be absorbed by higher yields on both domestic treasuries and open market operations, they add.

The higher interest rate bill facing the government could put pressure on the currency and also risks further straining the deficit in the budget, where more than 36% of spending already goes to service government debt.

Mhango at Renaissance Capital forecast the pound would slide to 16.2 pounds to the dollar by the end of June.

“I think they’re (the central bank) trying to move towards moderately depreciating the currency as opposed to keeping it at a near peg, as we’ve seen,” Mhango said. “I don’t think they will continue to try to throw everything at the Egyptian pound to try to keep it pegged.”

TOURISM FACES NEW PAIN

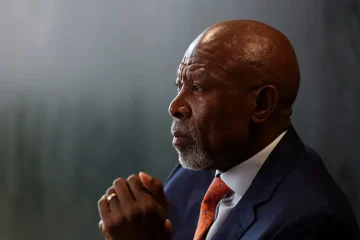

In December, central bank governor Tarek Amer said that monetary authorities felt during the pandemic that a weaker exchange rate would not bring back tourists or boost exports, prompting them to intervene with substantial reserves.

While the carry trade in treasuries has been protected, the government has taken on more debt as it seeks to cover for a loss of tourism revenue since the pandemic’s outbreak two years ago.

Yet now the Ukraine crisis threatens to deal a new blow to tourist numbers.

Russians make up roughly 10% of Egypt’s tourists, while Ukrainians account for about 3% although few official statistics are available, said Elhamy El-Zayat, chairman of Emeco Travel.