MOZAMBIQUE’S lawsuit against Credit Suisse and shipbuilder Privinvest over the decade-old “tuna bond” scandal in London could pitch one of the world’s poorest nations against corporate heavyweights in a $1.5 billion-plus battle next week.

Credit Suisse’s parent UBS and the African republic were on Friday locked in out-of-court settlement talks, according to one source in Mozambique’s Attorney General Office and two sources familiar with the situation, who asked not to be named because the negotiations were confidential.

The 11th-hour bid to secure a deal would allow Swiss banking giant UBS to resolve an inherited legal headache and escape the scrutiny of a three-month High Court trial due to start on Monday.

If talks fail, the Swiss bank, three of its former bankers, Emirati-Lebanese shipbuilder Privinvest and its French shipping mogul boss Iskandar Safa will have to defend their roles in deals designed to finance a fishing fleet and maritime security.

In the case, also known as the “hidden debt” scandal, hundreds of millions of dollars went missing, the African nation was pitched into a protracted economic downturn and the Mozambique and U.S. governments launched criminal proceedings.

UBS declined to comment and Privinvest did not immediately respond to a request for comment.

WHAT IS AT STAKE?

Mozambique is hoping to revoke a sovereign guarantee on a loan it alleges was corruptly procured and secure compensation for other alleged wrongdoings.

The case is one of the biggest legacy disputes inherited by Swiss banking giant UBS, which rescued scandal-scarred Credit Suisse earlier this year.

WHAT ARE THE MOZAMBICAN ‘TUNA BONDS’?

Three state-owned Mozambican companies struck deals in 2013 and 2014 with Privinvest and banks including Credit Suisse for loans of about $2 billion.

The loans were secured with undisclosed government guarantees and billed as being for projects such as a state tuna fishery. Credit Suisse sold on much of its exposure to international investors.

When the scale of missing funds and borrowing became public in 2016, donors including the International Monetary Fund halted support, triggering a debt default and criminal investigations.

WHAT ARE MOZAMBIQUE’S ALLEGATIONS?

Mozambique alleges it was the victim of a conspiracy and that Privinvest paid more than $136 million in bribes to corrupt officials and Credit Suisse bankers, exposing it to a potential liability of at least $2 billion.

It alleges, in part, that Credit Suisse is liable for the actions of its bankers, who worked on the deals and who pleaded guilty in the U.S. in 2019 to conspiracy to breach anti-bribery laws and commit money laundering.

Credit Suisse agreed to pay about $475 million to British and U.S. authorities in 2021 to resolve bribery and fraud charges and pledged to forgive $200 million of Mozambican debt.

WHAT DO THE DEFENDANTS SAY?

Credit Suisse alleges it was unaware of the misconduct of its bankers at the time. Its former bankers deny being part of a conspiracy.

Privinvest alleges it delivered on its contractual obligations and any payments made were investments, consultancy payments, legitimate remuneration or political campaign contributions.

WHO ELSE HAS BEEN CHARGED?

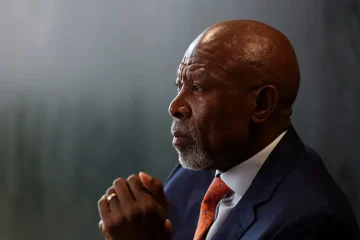

Ex-finance minister Manuel Chang, who signed the sovereign guarantees, was extradited to the United States in July from South Africa. He pleaded not guilty to U.S. criminal charges of conspiring to commit wire fraud, securities fraud and money laundering. He is scheduled to appear in a Brooklyn federal court on Oct. 27.

A former central bank governor and two ex-central bank employees were charged in Mozambique alongside Chang, facing allegations they abused their positions.

In December, a Mozambican criminal court found a former president’s son and 10 others guilty of charges including money laundering and bribery, sentencing them to more than 10 years in jail.