KENYA’S President William Ruto said the government was poised to privatise 35 state companies after enacting a law last month to guide the process.

Kenya last privatised a state-owned company in 2008 with an initial public offering (IPO) for 25% of the shares in telecommunications firm Safaricom.

“We have identified the first 35 companies that we are going to offer to the private sector. We have another close to 100 we are working with financial advisers on what to do,” Ruto said in remarks at the opening ceremony of the African Stock Exchanges Association’s annual meeting in Nairobi.

Finance Minister Njuguna Ndung’u told Reuters that the names of the firms to be sold would be announced at a later date.

The East African country’s public finances have been pressured by the legacy of the COVID-19 pandemic and frequent climate change-induced droughts and there is uncertainty over its ability to access funding from financial markets before a $2 billion Eurobond matures in June

While Ruto said Kenya would now be able to offload potentially “lucrative” companies where growth has been limited by bureaucracy, Ndung’u denied the listing drive was intended to shore up government finances.

“One of (the aims) is to inspire market activity. Cash is a secondary issue,” he said.

Ruto said Kenya revised its privatisation law last month to remove “unnecessary bureaucracies” and that the government’s new drive would boost Africa’s pipeline of company floatation.

Bourses on the continent have underperformed this year as global investors shunned assets perceived as risky, with a dearth of listings, a rise in global interest rates and China’s economic struggles.

With 40 exchanges across the continent, Africa could have as many as five company listings a day, Ruto said, but there were barely any, partly due to regulatory red tape.

“If well harnessed, stock exchanges can be the engine that transforms Africa into a global economic powerhouse and financial centre of the world,” the president said.

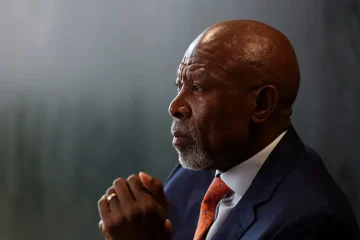

Thapelo Thseole, ASEA’s president who is also CEO of the Botswana Stock Exchange, said regulatory changes in some countries had led to recent IPOs, citing a listing in Uganda by telecoms firm Bharti Airtel.