NIGEIA is aiming to reduce the number of taxes levied by federal and state governments from more than 60 to fewer than 10, the head of a tax reform committee said, part of changes to make it easier to conduct business and to boost revenues.

Africa’s biggest economy, Nigeria, has a tax-to-GDP ratio of 10.8%, one of the world’s lowest, forcing the government to rely on borrowing to fund its national budget.

Investors often cite Nigeria’s many taxes and multiple revenue collection agencies for adding to the cost of doing business and discouraging investment.

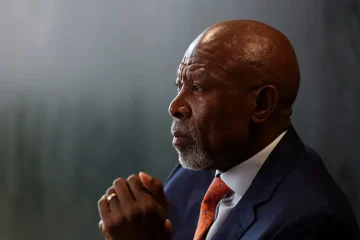

Taiwo Oyedele, President Bola Tinubu’s advisor on tax reform, told reporters that Nigeria has over 60 official taxes and levies collected by federal and state governments and local authorities, mandated by law.

Including unofficial taxes – taxes that agencies legally or illegally levy without the backing of law – Nigeria has more than 200 taxes, Oyedele said, adding that the large number was “making life difficult for our people.”

“The more taxes you have, actually, the less revenue you collect because it just creates the opportunity for leakages and some non-state actors collecting money and keeping it to themselves,” he said.

Oyedele said part of the reforms would see changes to the constitution to clarify which level of government should collect particular taxes.

Some states like Lagos, which generates the most tax revenue, passed laws last year designed to allow state governments to collect value-added tax rather than a federal agency, causing a dispute with the federal government that is before the courts.