NIGERIA’S central bank has sacked the boards and management of three lenders for non-compliance with banking regulations and corporate governance failures, it said.

The affected lenders are privately held Union Bank, Keystone Bank and Polaris Bank, each of which had come under government control in the past.

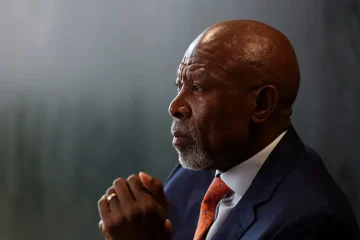

The move by Central Bank Governor Olayemi Cardoso comes as the sector gears up for an expected regulatory-induced capital hike which the governor has said is needed to support Nigeria’s economic growth ambitions.

“The Central Bank of Nigeria (CBN) has dissolved the Board and Management of Union Bank, Keystone Bank and Polaris Bank,” the regulator said.

“The banks’ infractions vary from regulatory non-compliance, corporate governance failure, disregarding the conditions under which their licences were granted, and involvement in activities

that pose a threat to financial stability, among others.”

Union Bank was recently sold to privately held Titan Trust Bank under former Central Bank Governor Godwin Emefiele, who was suspended by President Bola Tinubu on allegations of fraud.

Tinubu appointed a special investigator to probe the central bank under Emefiele and analysts said the sacking of the boards of the three banks could be linked to the outcomes of the investigation. The probe findings have yet to be made public.