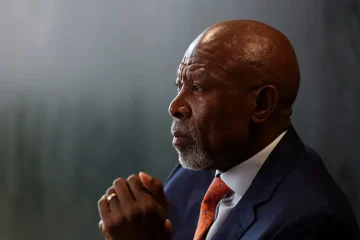

AFRICAN MIRROR REPORTER

SOUTH African Finance Minister Tito Mboweni today unveiled a 2021 “Budget of Hope” which contained tax relief measures, more government spending to stimulate economic activity as well as increases in the prices of alcohol and fuel.

Mboweni revealed that the government has set aside R19.3-billion for the purchase of COVID-19 vaccines for a nation where over 50 000 people have died and over 1.3-million have been infected. No new taxes would be introduced to fund the vaccines, which will be provided free of charge for the majority of South Africans.

He also tabled a Budget that did not introduce increases for personal and corporate taxpayers, in a move calculated to reduce the financial pressures on households and businesses.

The Finance Minister revealed an 8% increase on excise duties for alcohol and tobacco. The following increases, effective today:

- A 340ml can of beer or cider will cost an extra 14c

- A 750ml bottle of wine will cost an extra 26c

- A 750ml bottle of sparkling wine an extra 86c

- A bottle of 750 ml spirits, including whisky, gin or vodka, will

increase by R5.50 - A packet of 20 cigarettes will be an extra R1.39c

- A 25 grams of piped tobacco will cost an extra 47c

- A 23 gram cigar will be R7.71 more expensive

Mboweni said SA would collect R213-billion less tax than predicted in the Budget 2020 expectations.

On the taxes, Mboweni made the following announcements:

- The corporate income tax rate will be lowered to 27 per cent for companies with years of assessment commencing on or after 1 April 2022.

- The personal income tax brackets will be increased by 5 per cent, which is more than inflation. “This will provide R2.2 billion in tax relief. Most of that relief will reduce the tax burden on the lower and middle-income households. This means that if you are earning above the new tax-free threshold of R87 300, you will have at least an extra R756 in your pocket after 1 March 2021.”

- Fuel levies will increase by 27 cents per litre, comprising 15 cents per litre for the general fuel levy, 11 cents per litre for the Road Accident Fund levy and 1 cent per litre for the carbon fuel levy.

- An 8 percent increase in the excise duties on alcohol and tobacco products.

On social services, Mboweni said provinces will receive R3.5-billion from the Department of Social Development to improve access to early childhood development services.

‘R6.3 billion is allocated to extend the special Covid-19 social relief of distress grant until the end of April 2021. In addition, R678.3 million is earmarked for provincial departments of social development and basic education to continue rolling out free sanitary products for learners from low-income households,” he said.

Mboweni said regular social assistance grants are adjusted as follows:

- A R30 increase for the old age, disability and care dependency grants to R1890.

- A R30 increase in the war veterans grant to R1910.

- A R10 increase in the child support grant to R460.

- A R10 increase for the foster care grant to R1050.

He said the government remains committed to ensuring that deserving students are supported through higher education. The National Treasury was working with the Department of Higher Education and Training to work on policy and funding options.

On the government’s fight against corruption, Mboweni revealed that the Department of Justice and Constitutional Development has been allocated R1.8-billion to improve business processes. He said the allocation would support law enforcement agents in the fight against crime and corruption.

He explained: We are bringing the long arm of the law into the digital age through the Justice Modernisation Programme. SARS, SARB and the Financial Intelligence Centre (FIC) are working jointly on combating criminal and illicit cross-border activities through an inter-agency working group. This group has completed 117 investigations, and found R2.7-billion for our fiscus. Customs and excise operations are reducing the illicit movement of goods across borders, assisted by specialised cargo scanners, resulting in 3 393 seizures valued at R1.5 billion for the fiscal year to January 2021.”

Mboweni said a total of R791.2-billion has been set aside for infrastructure. He said: “We face many challenges as a developing country. We are confronting these head-on. Our country has a network of highways and byways which are the envy of many. The mighty N1 from Cape Town to Beitbridge, the scenic R71 that meanders through the misty mountains of Magoebaskloof and delivers us to the Kruger National Park, and the expansive N4 that stretches from Botswana across our country into Mozambique. They are part of the lifeblood of the region. Our great dams, bridges and railway lines have supported our economy for decades. However, much of this infrastructure now needs repair or replacement. Government has committed to a R791.2 billion infrastructure investment drive to this end. We are already partnering with the private sector and other players to rollout infrastructure through initiatives such as the blended finance Infrastructure Fund. However, all these efforts to expand infrastructure will be wasted if the end user does not pay a cost-reflective tariff for usage.”

Mboweni said one of the reasons for his optimism was that the 2021 Budget explicitly supports economic transformation and job creation.“ The R6.2 trillion spending envelope over the Medium-Term Expenditure Framework gives expression to the Economic Reconstruction and Recovery Plan. This is not an austerity Budget. Our fastest-growing area of spending is our investment in the future-capital payments,” he added.

The Finance Minister said the Land Bank has been allocated R7-billion to help resolve the bank’s current default and re-establish the development and transformation mandate

The Department of Small Business Development has allocated R4 billion over the medium term to township and rural enterprises, including blended finance initiatives.

The Department of Tourism has reprioritised R540 million over the medium term to establish the Tourism Equity Fund (TEF) as one of the measures to support the tourism sector recovery. The fund will acquire equity stakes in existing tourism enterprises, support expansion of operations and development of new operations.

On South Africa’s debt outlook, Mboweni warned that the government was not “swimming in cash” and that public finances remain dangerously overstretched.

“Our borrowing requirement will remain well above R500 billion in each year of the medium term despite the modest improvements in our fiscal position. Consequently, gross loan debt will increase from R3.95 trillion in the current fiscal year to R5.2 trillion in 2023/24. We owe a lot of people a lot of money. These include foreign investors, pension funds, local and foreign banks, unit trusts, financial corporations, insurance companies, the Public Investment Corporation and ordinary South African bondholders. We must shore up our fiscal position in order to pay back the massive obligations we have incurred over the years.”