SAFARICOM PLC, Kenya’s largest telco, has fully acquired M-PESA Holdings Co. Limited, consolidating control of its mobile money service and cash cow, M-PESA.

Its buyback of M-PESA from Vodafone’s subsidiary Vodacom highlights its growth as a mature, independent African entity in the global telecommunications arena.

In April 2020, Safaricom and South Africa’s Vodacom completed the acquisition of the ubiquitous mobile money platform from Britain’s Vodafone.

Experts argue the new buyout, which was finalised on October 15, 2023, could mark a turning point in the company’s push for profitability beyond its East African home turf.

Safaricom will now have sway over the major aspects of its mobile money service which was pioneered in Kenya but whose intellectual property it previously held with Vodacom.

It thus gives it full ownership of the intellectual property rights and patents of the mobile money platform which would be critical as it seeks a more continental expansion.

Safaricom is also expected to save millions of dollars in royalties paid to Vodacom thus preventing further blood-letting on its balance sheets after it encountered financial headwinds in its Ethiopian expansion.

Investor analyst Aly-Khan Satchu posits that the real catch for Safaricom is if it can easily access M-PESA deposits.

“The main issue here is whether Safaricom can more directly access the customer deposits that sit in M-PESA Holding. Since Safaricom embarked on its Ethiopian adventure, its cash flow has been crimped. Easier access and less intermediation would be a meaningful win”.

By acquiring M-PESA Holdings, Safaricom may be able to access the customer deposits that sit in M-PESA Holding and use them as a source of funding for its Ethiopian expansion.

This would reduce Safaricom’s reliance on external financing and lower its borrowing costs. It would also give Safaricom more liquidity and flexibility to manage its cash flow.

Safaricom has been facing cash flow challenges since it embarked on its Ethiopian adventure in 2021.

Safaricom’s net income for the 12 months through March was 62.3 billion shillings ($455.6 million), 10.6% lower than the previous year, due to the costs of rolling out operations in Ethiopia. That was its biggest drop in since 2011, according to data compiled by Bloomberg.

But despite its full M-PESA ownership, however, accessing the customer deposits may not be as easy as it sounds.

Safaricom would still have to contend with the regulatory framework that governs the trust account and ensure that the customer funds are not compromised or misappropriated as stated in the National Payment System Regulations of 2014.

Safaricom would also have to maintain the trust and confidence of its customers who use M-PESA as their primary financial service provider.

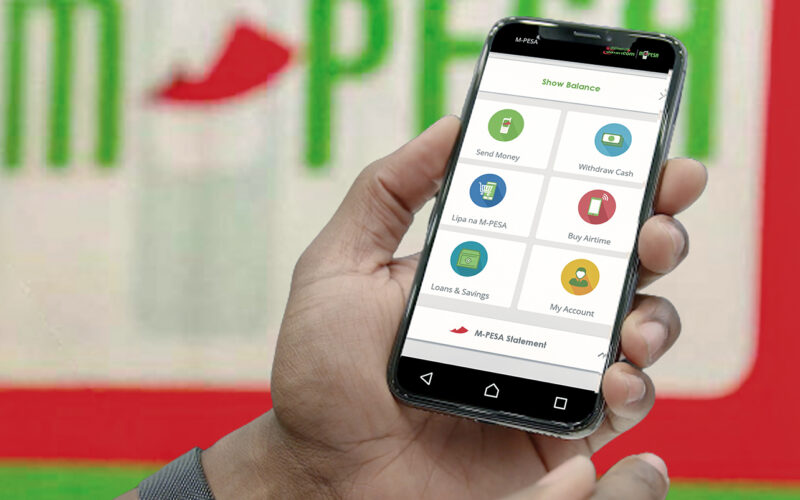

Currently, M-PESA is the most successful and widely used mobile money service in Africa, with over 50 million active customers across several countries.

It allows users to send and receive money, pay bills, shop online, and access other financial services using their mobile phones. M-PESA has been praised for its role in promoting financial inclusion, especially for the unbanked and underbanked segments of the population.

Safaricom used to share the ownership and management of M-PESA with Vodacom International Holdings BV, a subsidiary of Vodafone Group PLC.

However, Safaricom decided to buy out Vodacom’s stake in M-PESA Holdings for an undisclosed amount, making Safaricom the sole owner of M-PESA.

According to Safaricom, this acquisition will enable it to have more control and flexibility over the strategic direction and innovation of M-PESA.

The IMF estimates show Africa has more digital financial services users than any other region in the world, accounting for nearly half of the 700 million individual users globally.

In 2011 the level of financial inclusion in Africa was just over 23% and jumped to almost 43% in 2017, buoyed by the growth of digital financial services. The figure is expected to be much higher today.

According to the AfDB, financial inclusion has grown dramatically in recent years, as seen in the number of countries that committed to the Maya Declaration and the G-20 Financial Inclusion Action Plan, as well as strategies and targets set by individual governments.