BIRD STORY AGENCY

THE viral nature of African tunes is not only creating a broader audience for African artists but also unleashing an unprecedented revenue boom.

The fastest-growing market region in 2022 was Sub-Saharan Africa, according to a new report. Growth in the region, which recorded a 34.7% rise in music sales, was largely driven by a booming music market in South Africa, where sales were up by more than 30% year-on-year.

This is according to a report by the International Federation of the Phonographic Industry (IFPI), which represents over 8000 record company members worldwide, including all three major labels, Universal Music Group, Sony Music Entertainment and Warner Music Group.

Released on March 21, 2023, the Global Music Report 2022 shows that the global recorded music market grew by 9.0% year-on-year in 2022, driven by growth in paid subscription streaming. The report reveals that total trade revenues for 2022 were $26.2 billion.

Sub-Saharan Africa posted the highest revenue growth rate.

“Four regions posted double-digit gains, outpacing the overall growth rate of 9.0% and Sub-Saharan Africa overtook the Middle East and North Africa as the fastest growing area,” said IFPI.

The growth was majorly boosted by “a strong climb in revenues in South Africa, the largest market.”

Music sales in South Africa had grown only marginally in 2021, by 2.4%, but leapt by a massive 31.4% in 2022.

According to the report, Nigeria and South Africa have continued to do impressively well with regard to producing break-out artists pushing Afrobeat and Amapiano tunes.

Music streaming leader Spotify reported this week that its data showed Amapiano tracks generated close to 2 billion streams last year, representing a 143% increase over 2021.

“The genre has garnered a huge following, with over 240,000 playlists featuring Amapiano in the title and over 10-million playlists featuring at least one Amapiano track. Over 40% of Amapiano streams come from listeners outside South Africa,” said Spotify.

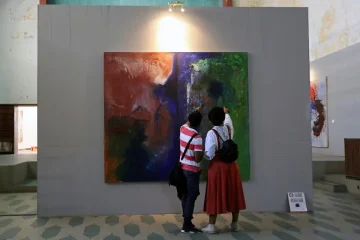

This penetration into the global space complements the growing value emerging markets such as Africa are putting on domestic music.

According to Temi Adeniji, the Managing Director of Warner Music Africa, the recent wave of digitalisation in Africa drives increased revenues for music creators.

“Across the continent, we’re seeing users switch from traditional media to digital platforms. That shift is benefiting artists and music as they’re at the heart of mainstream digital platforms, from audio streaming to short-form video,” she noted.

In addition, there has been increased recognition of the value of local repertoire, leading to more support for indigenous artists.

The impact and influence of domestic music have also been on the rise, contributing to the growth and development of the industry in the region.

Adam Granite, Universal Music Group’s CEO for Africa, Asia and the Middle East, admits local cultures have been vital in firing up African music’s global growth.

However, according to Adeniji, “converting users from ad-based services to paid subscriptions” is still a challenge limiting full-blast revenue flows.

Consequently, record labels are forced to rely on ad-based services to increase subscriptions.

“In South Africa, for example, we only have around 4 million paid subscribers in a country of more than 50 million people. So we have to make sure that more ad-based services act as a funnel to subscription,” she explained.

As artificial intelligence technology continues to advance, the report suggests that its potential for enhancing the economic value of the music industry through positive application cannot be overlooked.

“AI is already a key component to the business and can play a positive role in analysing and understanding fan engagement trends,” said Dennis Kooker, president of Global Digital Business, Sony Music Entertainment.

In terms of individual (country) markets, the US retained its number one position, with music sales growing 4.8% and exceeding US$10 billion in recorded music sales for the first time.

Japan was in second place, while the third and fourth-biggest markets for recorded music were the United Kingdom and Germany, respectively. With music sales growth of 28.4%, China became a top-five global market for the first time in 2022.