CONRAD ONYANGO

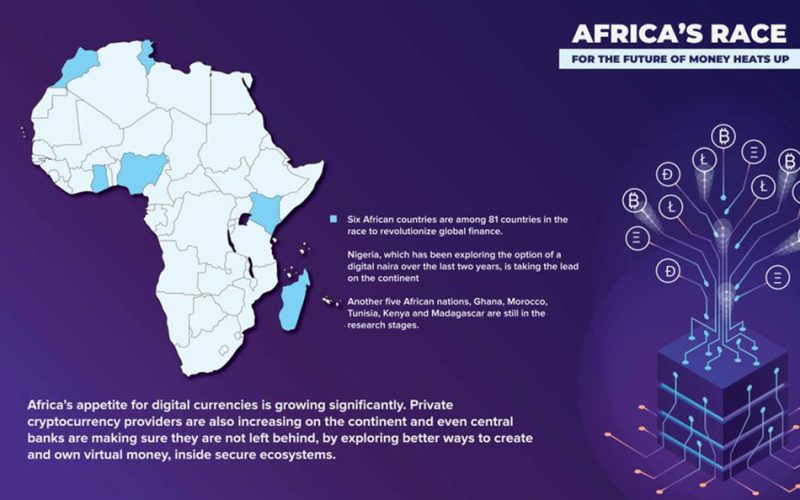

AFRICA’S appetite for digital currencies is growing significantly. Private cryptocurrency providers are also increasing on the continent and even central banks are making sure they are not left behind, by exploring better ways to create and own virtual money, inside secure ecosystems.

A number of African countries are looking to launch their own virtual money, backed and issued by central banks, as appetite for digital currency grows exponentially across the continent.

A Central Bank Digital Currency tracker from US think-tank, Atlantic Council, shows six African countries are among 81 countries in the race to revolutionize global finance.

The tracker shows that Nigeria, which has been exploring the option of a digital naira over the last two years, is taking the lead on the continent, with that possibility the country may launch a pilot scheme for its citizenry before the end of 2021.

According to the West African country’s central bank, Nigeria is keen to improve the efficiency of the flow in foreign remittances, the country’s second-largest forex earner after oil. A digital currency could assist.

Another five African nations, Ghana, Morocco, Tunisia, Kenya and Madagascar are still in the research stages.

Ghana is looking at allowing a digital currency pilot following the launch of a fintech regulatory and innovation live testing pilot. The pilot will also give preference to projects using blockchain technology from early in the new year. Ghana has christened the digital currency project, E-Cedi.

After a four-year ban, the Moroccan Central Bank has formed an exploratory committee to determine the positive and drawbacks of a regulated digital currency ecosystem to its economy.

Tunisia is exploring ways to advance its e-dinar, a blockchain-based digital version of the Tunisian dinar that has been on issuance through the government’s post office over the last five years.

The Central Bank of Madagascar has embarked on a two-phased project to study the issuance of a digital currency called e-Ariary that will entail analysis, design and experimentation before implementation.

The “mushrooming of private cryptocurrencies” has also sparked interest in a regulated digital ecosystem in Kenya, with the country’s central bank saying it has initiated discussions with global players about central bank digital currencies.

The high cost of sending cash home from overseas – an important catalyst for development and social upliftment – has also emerged as a top motivator for the growing popularity and adoption of virtual currencies in the continent.

Blockchain data platform, Chainalysis, in its 2020 Geography of Cryptocurrency Report shows that Africa leads other regions in the world on retail-sized transfer of below USD 10,000. Between July 2019 and June 2020, Africa’s cryptocurrency volume retail share accounted for 29 percent, compared to Latin America and other regions in the developing world that scored below 20 percent.

“Roughly USD 3.7 billion worth of cryptocurrency was transferred to and from overseas addresses to ones based in Africa over the time period studied, with USD562 million of that coming in retail-sized payments under USD10,000,” said the report.

The World Bank report shows that most individuals pay an average of between nine and 15 percent in transaction fees, to send home remittances of below USD 200, compared to a global average of 6.8 percent.

Other economies that are also exploring the best avenues and implementation strategies for a regulated regime include Tanzania, South Africa and Egypt.

Tanzania has set up a team to work on a directive from President Samia Suluhu that called on the country’s central bank to ‘prepare for cryptocurrencies’. The team is to ‘advise government on policy, legislation and guidelines for effective use of technology’.

Egypt’s central bank, through its ‘Regulations Governing Provision of Payment Orders through Mobile Phones’, has allowed banks to issue electronic currencies, subject to its supervision, provided that each coin in the mobile payment service equals one Egyptian pound.

“E-Money units shall mean electronic units of monetary value equivalent to 1 Egyptian pound each. These shall be issued by a bank operating in the Arab Republic of Egypt under the supervision of the Central Bank of Egypt,” it said.

The South African Reserve Bank (SARB) has embarked on a feasibility study to examine the pros and cons of a central bank digital currency (CBDC).

A comparative report by blockchain infrastructure platform Bison Trails shows that 80 percent of central banks across the globe are exploring use cases involving central bank digital currencies (CBDCs) and some 40 percent are already testing proof-of-concept programs.

Even as governments accelerate efforts to build a secure ecosystem for digital currencies, more people on the continent continue to use cryptocurrencies from private sector players.

The U.K.-based crypto company Luno, for instance, reports that 4.7 million of its 7 million global customers are in Africa, an amount that has doubled in just one year, from the 2.3 million in 2020.