[tta_listen_btn listen_text=”Audio” pause_text=”Pause” resume_text=”Resume” replay_text=”Replay”]

AFRICA’S growing need for fresh water and increasingly abundant and cheaper renewable energy sources together offer a growing opportunity for desalination, according to the founder and managing director of Terra Energy, a consulting firm specializing in market research, business development, and training in sustainable energy.

“Desalination is an energy-intensive process and energy costs account for the majority of a plant’s typical operating expenditures,” said Mohamed Alhaj, noting that energy consumption translates to 44% of total water costs in more energy-intensive desalination options, such as Reverse Osmosis.

However, the continent’s vast renewable energy potential “could provide a significant source of cheap power for growing desalination demand.”

Desalination plants are gaining renewed attention as both public and private sectors across the continent look to leverage renewable energy.

Desalination removes dissolved salts and other minerals from seawater or brackish water, making it suitable for drinking or irrigation.

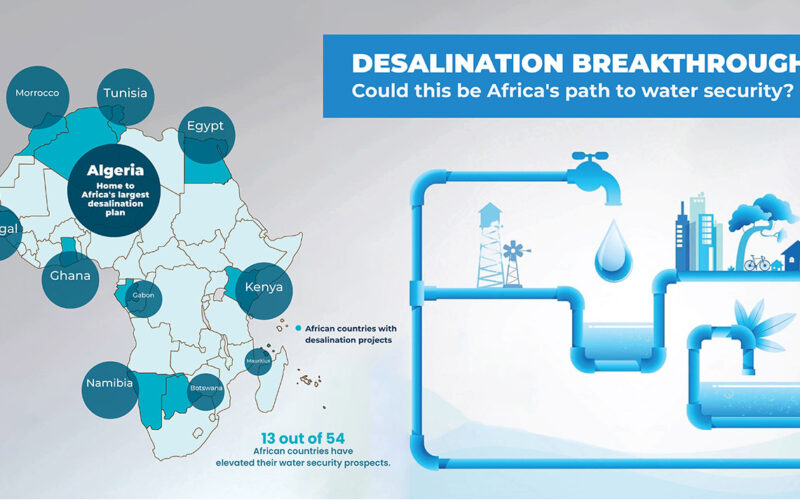

The World Health Organization estimates that 1 in 3 people in the continent are affected by water scarcity. Despite this challenge, a 2022 study by the UN University Institute for Water Environment and Health found that 13 of 54 countries have elevated their water security prospects.

These include Egypt, Botswana, Gabon, Mauritius and Tunisia, all of which have high volumes of saline waters. All five countries turned to desalination to improve water security.

In December 2022, Egypt announced a US$3 billion initial phase for desalination facilities, consisting of 21 new desalination facilities to be completed in 2023. They will add to the more than 80 such plants in the country that already process over 1 million meters cubic of saline water.

In Tunisia, the government is targeting desalinating 650 million cubic meters daily to boost its clean water volumes, especially for agricultural use, with construction underway on three plants in Gabes, Sfax and Sousse, all of which are expected to be operational by the end of 2024.

There are plans to launch four more stations, according to the CEO of Tunisian Water Distribution Utility, Ben Guerdane.

Similar trends can be witnessed in Algeria and Morocco, with a blend of government and private sector investments targeting desalination to boost the agricultural sector.

Algeria is home to Africa’s largest desalination plant, the Hamma Seawater Desalination Plant, with a freshwater production capacity of 200,000 cubic meters per day.

The North African country boasts more than 11 desalination plants, collectively producing 17% of the national drinking water demand.

Private sector involvement across the continent is also increasing.

In Kenya, local water solution provider, Davis & Shirtliff recently launched a new product which it believes has the potential to disrupt the desalination market.

According to Philip Holi, the company’s technical director, the company’s new ‘Dayliff Battery-less Solar RO’ plant “is poised to revolutionize solarized water treatment applications… it paves the way for a new era in the industry especially for industrial and commercial uses.”

Recent developments show promising trends for desalination technology across the continent. While some countries – notably South Africa, which was prompted to explore desalination when a drought famously brought Cape Town close to a “day zero” water depletion scenario – are only beginning to test the technology, others like Ghana have been using the technology for over a decade.

From Madagascar to Tanzania, Kenya to Ivory Coast, there has been a modest but relatively fast rise in the number of desalination plants being rolled out.

Namibia will see soon the establishment of the country’s second plant. To be operated by Orano Mining, the plant is projected to process 20 million cubic meters a year, with a potential expansion of up to 45 million cubic meters a year.

Senegal launched construction of the Mamelles Sea Water Desalination in July, to boost clean water supplies to the country’s capital. The facility is expected to provide 50 million litres (50,000 cubic meters) a day once completed in 2024.

A 2022 World Bank report projects water demand in Dakar to rise by between 30 and 60 million litres per day by 2035.

Another 2022 study shows the desalination market in developing countries, especially in Africa’s most water-scarce countries, could reach 37 million cubic meters per day by 2050. That would require an increase in desalination capacity of over 1,500% according to the report.

According to Alhaj, this will require a considerable effort from both government and private sectors and the recognition of desalination as a key element in national water strategies, as well as ” increased advocacy for projects, investment in more decentralized modular desalination systems, addressing policy gaps and capitalizing in water trade agreements to pool resources.”