ON July 5 2023, a Chinese mining company officially opened a lithium processing plant worth US$300 million in Zimbabwe.

The Zhejiang Huayou Cobalt plant is located in Goromonzi, about 80km southeast of Harare.

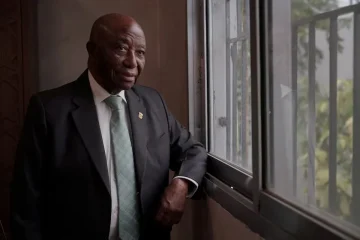

Zimbabwe President Emmerson Mnangagwa, who officiated at the commissioning, told those gathered for the event that the investment would help the country’s mining industry grow its value to US$12 billion by the end of 2023 and contribute to achieving the country’s Vision 2030 to elevate Zimbabwe to an upper middle-income economy.

“This investment will undoubtedly contribute to the mining sector targets set out in the national development strategy as well as our country’s overall national vision 2030,” he said.

The government first unveiled its policy document outlining its ambitious plans mining sector in October 2019,

Zimbabwe is home to over 40 types of precious metals, base metals, industrial metals, and gemstones. The country has the largest lithium reserves in Africa and the sixth largest globally. Lithium is essential for producing electric vehicle batteries, which are currently in high demand worldwide.

Zimbabwe also boasts the world’s second-largest platinum deposits after South Africa and high-grade chromium ores, with approximately 3 billion tons of PGM and 10 billion tons of chromium ore.

In 2022, Zimbabwe’s earnings from minerals were US$5.627 billion, according to the Reserve Bank of Zimbabwe in its Monetary Policy Statement in February 2023.

According to the Chamber of Mines in Zimbabwe, the mining industry in Zimbabwe has the potential to grow to a US$18 billion-a-year industry by 2030 (CoMZ). However, to achieve this goal, it will be necessary to address the sector’s key challenges.

Currently, Zimbabwe’s mining and natural resources sector is hindered by political in-fighting, a patronage economy, widespread corruption by the ruling party’s administration, an inadequate regulatory framework, an inefficient infrastructure system, and power outages, according to experts.

They say that the US$12 billion target, though achievable over the long run, is not a realistic target for the current year.

“I think we are on course. Unfortunately, this country is still facing electricity supply challenges and under that background, the realisation of a US12 billion mining industry can not become a reality,” said Prosper Chitambara, a development economist at the Labour and Economic Development Research Institute of Zimbabwe.

Recent power blackouts have been caused by climate change-induced droughts. The country’s main hydropower source, Lake Kariba, located on the Zambezi River, has been experiencing low water levels, reducing energy generation. But according to Chitambara, the issues affecting the industry are more deep-seated.

“The policy environment is also not conducive to macroeconomic stability, and that’s critical again for any sector. For investment to grow in any sector requires macroeconomic stabilisation, and that’s characterised by low and stable inflation,” Chitambara added.

Chitambara also pointed to Zimbabwe’s inadequate infrastructure, especially in the transportation sector, as a major obstacle to achieving the country’s goals.

“We have limited railway capacity, poor roads and insufficient air transport infrastructure and this makes it difficult for mineral transporters to export their goods, resulting in higher transportation costs and delays, thereby thwarting the US$12 billion mining goal”, he said.

Economic consultant and analyst Vince Musewe said the biggest impediment to the US$12 billion mining industry target is a lack of transparency and corruption within the mining value chain.

“Getting our mining sector going is a good thing. In fact, it’s well overdue. Zimbabwe has 40 mineral types and we have not even begun to really explore them. The key issues remain are those of corruption and monopolies in the sector,” he said.

“An increase in mining revenues will not necessarily result in income redistributions so that as many benefit. That is what is more important. We have skewed ownership strictures where a few connected elite benefit, so the US$12 billion target is exciting – but to whose benefit?”

In February 2023, Al Jazeera aired a four-part documentary titled ‘Gold Mafia’, exposing the looting of gold reserves via smuggling and money laundering by high-ranking officials within the ruling party, which the documentary said led all the way to the president, casting a further pall over the mining sector.

Another economist, Nlolwazi Nkosi from the University of Zimbabwe, explained that Zimbabwean institutions tend to be characterised by deficient and disruptive operations caused by narrow self-interest, making it difficult for the mining industry to grow as projected.

“Governance of the mining sector in Zimbabwe is fragmented, and it requires policy clarity, integration of legislation and the inclusion of all actors in decision-making.

“There is also a lack of serious political reforms in the country, combined with the perception of an arbitrary legal and regulatory system, which impacts the investors’ decisions,” she said.

The country is also facing limited access to foreign currency, which makes it difficult for mineral exporters to pay for the importation of machinery and spare parts, which are necessary for their daily operations, thereby hampering their production, as well as delayed payments to suppliers, and difficulties in meeting export orders.

Although there are numerous obstacles in the way of the US$12 billion milestone, the mining sector remains a key driver of the country’s economic development. And despite the headwinds, it continues to attract significant foreign investment – helping to revive the struggling economy.