CONRAD ONYANGO, BIRD STORY AGENCY

GIANT payment processing firm Mastercard has begun a push for public-private partnerships with African governments to leverage its digital ID infrastructure – Community Pass – as digital identities become a key way to include even the most remote communities in a global digital economy.

During a recent US Vice President Kamala Harris’s visit to Zambia, Mastercard’s Division President of Sub-Saharan Africa, Mark Elliott, called for a rethink in national financial inclusion strategies, to close the digital divide.

“To date, we have enabled 2.4 million individuals in Africa – mostly smallholder farmers – to participate in the digital economy,” said Elliott.

The early success “highlighted the power of technology and innovation to connect everyone to the digital economy, enabling service delivery across diverse sectors, and driving economic growth,” said the payment firm.

Community Pass offers a ramp for underserved communities to access critical healthcare, education and financial services.

In April, the pass received a clean bill of health from ID2020 Alliance, a global alliance that sets technical requirements for “good” digital identity by prioritising privacy, user control and interoperability.

This gives Mastercard more leverage to aggressively run with its ambitious plan of registering 15 million users to its digital ID and payment platform by 2027.

US Vice President Harris also referenced Community Pass as critical in bridging the global gender digital divide. The US has earmarked at least half of its US$60 million global fund to help increase African women’s participation in the digital economy.

Digital ID verification company Smile Identity, in its State of KYC in Africa 2022 report, shows a growing interest in a robust, functional and secure digital identity infrastructure across the continent on the back of rising fraud cases.

“Strong digital identity infrastructure can provide a starting point, making it easier and safer for people to take part in the digital economy,” according to the report.

According to IFC and Google-backed report, Africa’s digital economy will reach US$180 billion by 2025 and grow to US$712 billion by 2050 on rising access to high-quality internet access, a young urban population, and a vibrant tech startup ecosystem.

“Widespread adoption of digital ID in Africa will unlock new opportunities for development and growth,” say authors of the Smile Identity report.

Several countries are at different stages of digitising identity credentials for their populations to speed up the onboarding of millions of people locked out of the expanding digital economy due to a lack of legal identity.

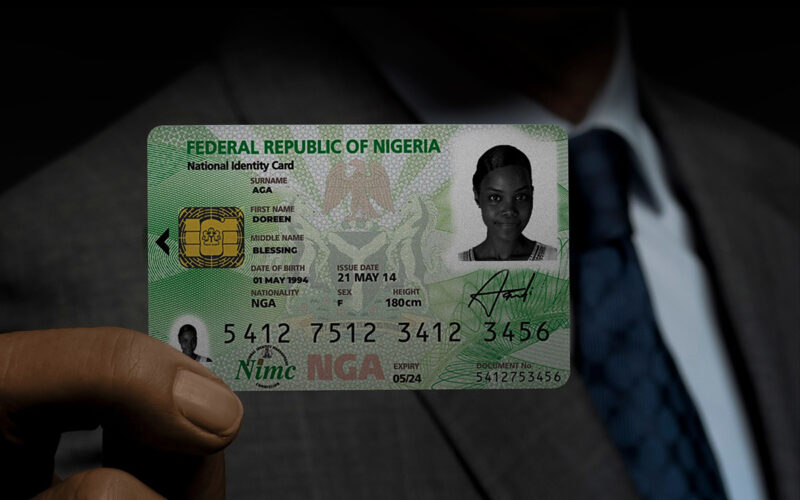

Nigeria is leading Africa’s digital ID revolution, registering 94 million of its over 200 million population by the end of 2022.

Ethiopia, among the latest African countries to venture into biometric Identities, has registered over 1.4 million users under its national ID program that targets 70 million people by 2025.

Other countries that have so far introduced national biometric digital identity cards include Mozambique, Tanzania, Zimbabwe, Zambia, Lesotho and Uganda.

In August 2022, Uganda announced plans to introduce ‘smart’ digital IDs beginning in 2023 with a plan to enrol 17 million unregistered citizens. The smart ID’s ability to identify people’s eyes and recognise their DNA is set to replace the analogue once expiring in 2024.

Kenya, which had made significant progress with its Huduma Number- a single card linking up an individual’s all identity document credentials- is pursuing a new route.

The country’s new administration said it is creating a digital identity for virtual transactions that will not require people to flush out physical cards.

In February, Kenya’s ICT Cabinet Secretary, Eliud Owalo, set February 2024 as the official roll-out date for the country’s new identity cards.

Economic Community of West African States (ECOWAS) are also mulling over a single digital Identity card by advancing cross-border interoperability of official identification.

Under a WorldBank-backed project, the West Africa Unique Identification for Regional Integration and Inclusion (WURI), six countries are to develop a regional digital card.

“The Commission aims to foster regional dialogues and cooperation for cross-border mutual recognition of foundational identity systems for access to services,” according to the ECOWAS commission.

The project is already being implemented by Benin, Burkina Faso, Niger and Togo, as Cote d’Ivoire and Guinea are in the pilot stage.

Data by WorldBank’s Identity for Development program (ID4D) shows that well over 400 million people in Africa lack official Identity documents.

The multi-lateral lender has revised its estimate for the global population without “official proof of identity” to just under 850 million in 2021 from under a billion in 2018.