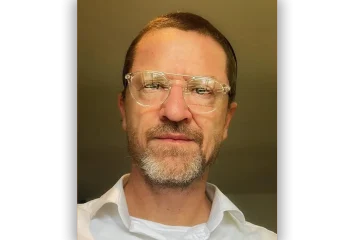

PATRICK NELLE

WHEN crypto startup Ejara recently inked a 2 million US dollar funding deal to bring to 5 million dollars the total amount out cash it has raised in 8 months, Francophone Africa sat up and took notice of the company – and its CEO and co-founder, Nelly Chatue-Diop.

The company is blazing a trail for startups in the sector in Francophone Africa, offering venture capital a new route to potentially lucrative markets and forcing venture capitalists who have traditionally focused on fintech opportunities in Anglophone Africa to shift their gaze. But while cryptocurrencies offer lucrative opportunities in Africa, there is a lot more to Diop’s championing of crypto than pure profit. There is also a historical wrong to be righted.

Diop studied computer science in France. But after a few years of regular employment, she decided to take a new career path. So, she completed an MBA at HEC Paris / London Business School. The MBA would help open the doors to financial institutions like Credit Suisse, where she worked as an investment banker.

“I am a “tech person who got exposed to traditional finance,” she explained.

But her path into the financial world was not entirely accidental. Memories of a regional economic crisis triggered in 1994 when France devalued the CFA franc, knocking her family out of business when she was a child, still linger. She is determined to prevent a repeat.

“As a kid, I think it was the first time that I saw my dad crying. We were part of the middle class. My father had done everything well, he had earned some money, he had saved money in a bank account, he had done everything well. But unfortunately, because of exogenous factors he could not control, overnight he lost more than half of it. Prices skyrocketed, salaries were not paid properly to public servants, the economic crisis started and all the economic life unravelled. And you are thinking like, what is the best system to allow people to protect if not all, at least part of their assets from such things out of their control?” she explained.

The answer, she believes, came years later when she came across an increasingly popular, blockchain-based currency – cryptocurrency. Today, Diop sees cryptocurrencies as the best option for Africans wanting to secure and grow their disposable income. In 2019 she created Ejara, a “decentralized investment and savings platform designed to serve Africans and the African diaspora”.

Since its inception, Ejara has scaled rapidly, addressing the rising demand for crypto in French-speaking African countries. The company markets to women and features innovative technologies like a non-custodian wallet (which allows the user to own the “key” to the cryptocurrency wallet) built from scratch by Ejara engineers.

“When you create your account you receive a code which will allow you to unlock your safe. Basically, crypto and blockchain allow you to be your own bank,” explained Ruth Foxe Blader, partner at Anthemis, a venture capital fund that supports Ejara.

“Nelly and her team are building Ejara in Africa. Her team and her advisors represent some of the most respected experts in crypto, engineering and the local regulatory environment in the region. Ejara’s on-the-ground approach allowed them to grow thousands of users even before any formal launch,” she said.

The African crypto market has grown 1,200% since 2020, according to a report released by Chainalysis. Ejara now has 8000 subscribers, with women accounting for 40% of the users. Assets valued at 3.4 million US dollars have been exchanged so far through the platform and figures are expected to rise rapidly.

Diop says Ejara’s short term goal is to scale and expand to eleven countries in Francophone African in the next twelve months.

Diop also refuses to be distracted by the gambling mentality often associated with cryptocurrency traders. She believes it’s necessary to educate both her own subscribers and the public about the risks of crypto trading, the potential volatility of cryptocurrencies and the notion of investing only what one can lose if one decides to trade crypto. For her, however, crypto is a long-term solution to a problem she first experienced as a child: the loss of wealth because of a lack of control – be that on a personal, or national, or even regional, level.

“Play the long game and you will always prevail. Bring that resiliency saying that if the answer is not that you’re dying or you’re losing completely your health, you can make up for whatever hardship, whatever loss, whatever failure you temporarily experience. Life is a marathon, it’s not like a sprint,” she explained.

Nelly Chatue-Diop posing with her colleagues in Ejara’s office in Douala. Photo : Patrick Nelle