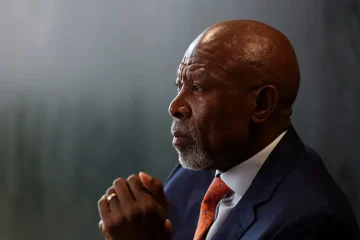

A former Mozambique finance minister pleaded not guilty to U.S. criminal charges over his alleged involvement in a fraud involving $2 billion in loans to three state-owned companies.

Manuel Chang entered his plea before U.S. District Judge Nicholas Garaufis in Brooklyn.

Chang had been extradited on Wednesday from South Africa, where he was arrested in December 2018 on U.S. charges of conspiring to commit wire fraud, securities fraud and money laundering.

Garaufis denied Chang’s request for bail, agreeing with prosecutors that he was a flight risk and could escape the charges by entering Mozambique’s U.N. mission in Manhattan.

“The evidence regarding his guilt on the face of it is strong,” Garaufis said.

Chang had proposed setting a $1 million bond.

The so-called “tuna bonds” case stems from financing extended to the three state companies by Credit Suisse and Russian bank VTB for projects to develop Mozambique’s fishing industry and improve maritime security between 2013 and 2016.

Prosecutors said at least $200 million was diverted to various defendants and Mozambican government officials.

Federal prosecutors said Chang secretly had Mozambique’s government guarantee the loans in exchange for bribes, and that the three companies were really “fronts” for Chang and other defendants to enrich themselves. The scheme misled U.S. investors about Mozambique’s creditworthiness, prosecutors said.

Chang’s lawyer Adam Ford said in court that Chang guaranteed the loans in his official capacity and did not take bribes.

“He intends to stay here and fight these charges,” Ford said.

The other defendants included Jean Boustani, a salesman for a Lebanese shipbuilding company accused of bribing officials and bankers to win contracts from state-owned companies.

He was acquitted at trial in December 2019, after he testified that he had no role in packaging the loans for investors.

Three former bankers at Credit Suisse pleaded guilty in 2019.

Credit Suisse, which was acquired by former rival UBS in a rescue this year, agreed to pay $475 million to Britain and the United States in 2021 to resolve bribery and fraud charges.

While Boustani’s company Privinvest did deliver ships and equipment to Mozambique, prosecutors said their value was grossly inflated.

Eventually, the loans defaulted and investors lost their money. Credit Suisse has forgiven $200 million that Mozambique owed.

In 2016, Mozambique unveiled previously-undisclosed state-backed borrowing, leading to a currency collapse and sovereign debt default after the International Monetary Fund and foreign donors cut off support.

The country is suing Credit Suisse and Privinvest in London for compensation and restitution.