KENYA’S KCB Group, a top two commercial bank, recorded a 6% fall in profit before tax for the first nine months of this year to 40.6 billion shillings ($266.51 million), it said.

KCB, which also operates in Uganda, Tanzania, Burundi, Rwanda, South Sudan and the Democratic Republic of the Congo, attributed the drop to a tough economic environment in its home market.

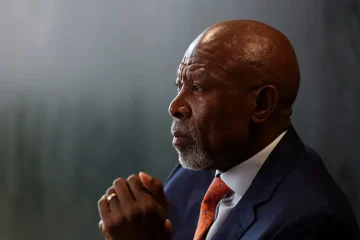

“We have had a rather difficult nine months due to a tough operating environment that has negatively affected our customers,” Paul Russo, KCB’s CEO, said in a statement.

The pressure on the Kenyan market was, however, offset by strong growth in some of the regional markets. Regional subsidiaries contributed 27.9% to group profit, KCB said, up from 16.4% a year earlier.

The group more than doubled its provisions for bad debts to 15.85 billion shillings, mainly due to the impact of a steep depreciation of the Kenyan shilling on customer loans that are denominated in dollars.

The ratio of non-performing loans, however, declined during the period, the bank said, attributing the drop to improvements in its Kenyan businesses and subsidiaries like Tanzania.

KCB’s income from transactions surged 39% during the period, while its net interest income rose 22%.