CAPITEC BANK reported an 84% rise in its annual profit, joining a slew of South African lenders who benefited from an upswing in performance as the impact from the COVID-19 fallout eases.

South African banks took massive hits to their profit in recent years, mainly due to large credit impairment charges related to the health crisis and associated government lockdowns. Lenders are now returning to pre-pandemic levels of performance as restrictions ease.

Profit at Capitec, the country’s largest retail bank by customer numbers, surpassed 2019 levels in the year ended Feb. 28. Its headline earnings per share – the main profit measure in South Africa – stood at 7,300 cents, in the middle of its forecast range.

That compared with 3,966 cents a year earlier, 5,428 cents in 2019.

However, Capitec did maintain its forward-looking credit provision, held for possible bad debts linked to the economic environment, at almost the same level as last year: 3 billion rand ($206.17 million).

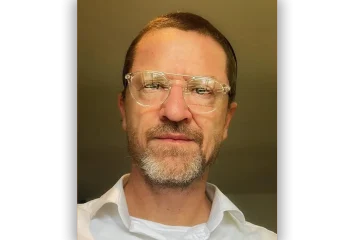

Chief Executive Officer Gerrie Fourie said apart from COVID-19 crisis, consumers were also under stress from high fuel prices and rapid inflation, while the Ukraine war and lockdowns in China – a key part of many industries’ supply chains – brought further uncertainty.

Capitec, which has historically attracted lower-income clients and is therefore seen as more vulnerable to downturns in the economy than its competitors, has been trying to shift towards higher earners.

This was beginning to show, Fourie said, with the bank seeing fewer cash-stressed clients, who have very little left over after all of their outgoing costs, in the book.

It has also stopped offering very high interest, short-term loans of up to six months, and 52% of its credit lines were now going to higher earners than previously.

“Our book has swung away … We can see the growth in our high-income clients coming through,” he said.