THE Tunisian cabinet approved a controversial bill allowing the central bank to finance the treasury, in a move aimed at financing the budget deficit but which reinforced fears over the bank’s independence.

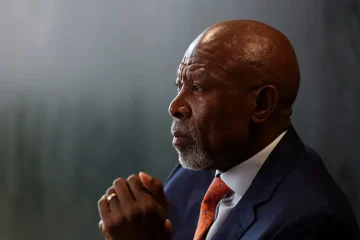

Last year, President Kais Saied said the law must be reviewed to allow the central bank to finance the budget directly by buying state bonds, a step bank governor Marouan Abassi has warned against.

Economists believe the bill’s approval by the cabinet enhances speculation the governor, who has headed the bank for six years, will leave the post next month at the end of his first term.

Critics of the move said amending the 2016 law indicated a likelihood of more state intervention in monetary policies, especially in light of the growing fiscal deficit, scarcity of financial resources, and difficulty in foreign borrowing.

Abassi warned in 2022 that government plans to ask the central bank to buy treasury bonds have risks to the economy, including more pressure on liquidity, high inflation, and a drop in the value of Tunisia’s currency.

He said the move would uncontrollably increase inflation which could be in the triple digits, and “a Venezuelan scenario will be repeated in Tunisia.”

It is widely expected the bill will be approved by Parliament in the coming weeks.

The government’s need for external loans is set to rise in the 2024 budget to about $5 billion, including $3.2 billion which the government did not say where it would be sourced.

“It is clear that the main source for obtaining this loans($3.2 billion) will be directly from the central bank,” said economist Aram Belhadj.