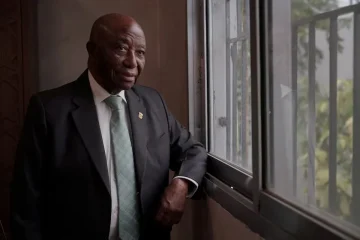

IN his journey from analysing blood samples to pioneering financial inclusion, the story of Olubayo Adekanmbi seems on the surface to be one of an unconventional career transition. Yet in many ways, the object of his metamorphosis was evident right from the earliest days of his very first job.

“The truth is that when you enable a woman financially, you literally help a family and thereby build a nation,” he said.

Growing up in Abeokuta in southwest Nigeria, like other boys, Adekanmbi aspired to be a medical doctor. He ended up as a biochemist, working in a local hospital. Today, he is working on a groundbreaking instrument that offers financial advice for rural women and small-holder traders, in their own languages.

The problem Adekanmbi is seeking to solve is one that faces millions of people across almost every country on the continent: imagine a woman market vendor or a local businesswoman in a rural area was able to rely on artificial intelligence to plan and understand complex financial terms by speaking into her phone, in a local dialect. What if there was an app available that could answer financial queries and provide instant responses in that language?

From early in his career, Adekanmbi could already see that many of the medical statistics he was crunching were simply the data representation of a far larger problem: women did not have the financial power to make better health choices for themselves or their children.

“About 31% of the nation’s population cannot read and write, and only 3% of Nigerians have access to loan services… Statistics show that 1 out of 2 Nigerian adults do not use any formal, regulated financial services,” Adekanmbi shared.

With years dedicated to studying patterns, Adekanmbi was well placed to recognise and understand gaps in the financing ecosystem. The most glaring? Communication.

“What we have built is a solution that allows people, especially women, who cannot read or write to track, plan, document, report and learn about their daily incomes and expenditures patterns, just by talking to their phones. Like the Talking Angela app, the users wait for a voice-based response in their local language. The solution can also tell them about the loans or financial products that are most appropriate for them, based on how much they earn and how they spend money,” Adekanmbi said.

Adekanmbi’s solution is an AI (artificial intelligence)-based financial chat service called Finchat. According to Adekanmbi, the bot requires an internet connection but he is working with telecom providers to make it free-of-charge.

“This is a solution we all need, especially market women,” was the reaction of Martha Omoru, from Benue in central Nigeria, when asked about the demand for a service like Finchat.

The president of the Small-scale Women Farmers Organisation in Nigeria (SWOFON), Mary Afan, said rural women are ready for services like Finchat, if it works in their local languages.

“This is a huge empowerment for our women. It meets one of our greatest needs because it bridges the gap for financial inclusiveness and reduces deception. A lot of women have been misguided in the past,” Afan, who had not yet tried the chatbot, shared.

The use of advanced technology to help groups of people overcome local challenges has become normal practice all over the world. Many use a Large Language Model (LLM), a deep learning algorithm that can perform a variety of natural language processing tasks. LLM’s have been in the spotlight ever since OpenAI launched ChatGTP, which accumulates information using an LLM, in November 2022.

“Leveraging on large language models [LLM] for financial inclusion, can lead to improved financial literacy, better financial decision-making, and greater participation in formal financial systems, ultimately contributing to economic empowerment and inclusivity in Nigeria,” Austin Okpagu, Managing Director at Jumia Pay, explained.

Adekanmbi’s all-Nigerian team of linguists, design engineers and artificial intelligence experts are united by a deep desire to solve developmental challenges. They are working with women’s groups to help them understand the solution and how they can use it – something that has led the engineers to realise additional features that can support users’ everyday financial well-being and focus on ease, convenience, and privacy, without compromising their personal data.

The data scientist registered his first technology company, in the United States, in December 2016. Data Science Nigeria (DSN) is dedicated to fostering Africa’s artificial intelligence talent ecosystem and pioneering cutting-edge solutions in health, retail and finance.

In 2022, the International Research Centre on Artificial Intelligence (IRCAI) recognized DSN’s AI-powered SMS Fraud Detector and Instant Fraud Prevention Call Alert as one of the Top 100 Global AI Solutions.

The chat service for his new AI chatbot, meanwhile, is still undergoing development. Thanks in part to a grant from the Bill and Melinda Gates Foundation, Finchat is being prepared to pilot in February 2024 in the Yoruba language. Before then, Adekanmbi hopes to refine it using Yoruba audio datasets.

“We have recently opened a language recording lab, which allows us to build the large language voice data required to train the AI to speak and understand more Nigerian languages. However, that takes time and is a huge investment. The plan is to build a “Siri” of Africa that can speak, understand, and engage in at least the 10 most popular African languages. One additional commitment we are making is to build rich audio datasets that recognise dialect differences in local languages,” Adekanmbi said.