THE skies are clearing for the African aviation industry, following the turbulence of the COVID-19 pandemic, according to the African Airlines Association (AFRAA), which reported a narrowing of the airline revenue gap in the first quarter of 2023 compared to the same period last year.

AFRAA is a 48-member African airline trade association aiming to promote, serve airlines, and champion Africa’s aviation industry.

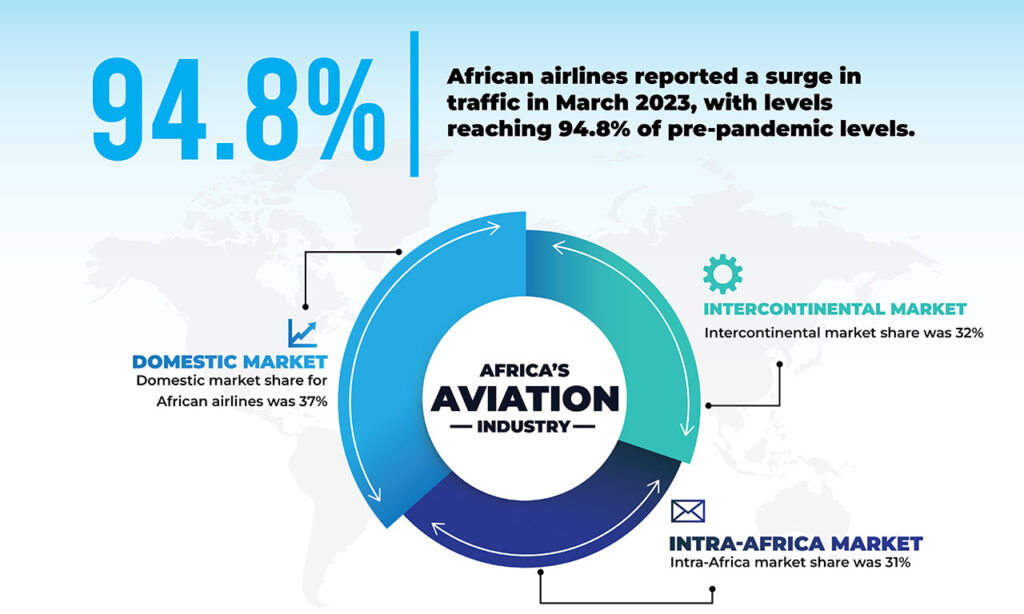

African airlines reported a surge in traffic in March, with levels reaching an impressive 94.8% of pre-pandemic levels.

A statement by AFRAA said that “domestic market share was at 37%, intra-Africa at 31%, and intercontinental at 32%.”

Moreover, first-quarter revenue in the sector was only $0.3 billion short of 2019 levels.

The association estimates the total number of passengers will hit 85 million, 10 million short of the full-year 2019 passenger traffic, but with the revenue gap projected to drop to $0.2 billion in the second quarter, the full-year revenue gap is expected to drop substantially from the $3.5 billion gap in 2022.

There is already tangible progress, according to the report, which points out that from October 2022, the number of intercontinental routes operated by African airlines exceeded pre-pandemic figures.

Also, in at least eight major airports assessed in the report, intra-African connectivity either reached or surpassed pre-pandemic figures.

The airports include those in Johannesburg, Nairobi, Addis Ababa, Lusaka, Cairo, Casablanca, Abidjan and Lome.

Air travel is also expected to benefit from a stabilisation in jet fuel prices.

The price of Jet A1 fuel continued to drop in the first quarter, with the global average price per barrel in the last week of March standing at $102.5.

The report also points to a significant opportunity to boost airline operations by releasing blocked funds – a phenomenon where airlines are unable to access the proceeds of their sales activities.

These funds could be a game-changer for struggling airlines.

Nigeria ranks second globally in blocked funds for airlines, with a staggering total of $743 million withheld by the country.

An AFRAA-led survey found that 3 African airlines had $44.2 million held in Nigeria for different reasons.

“These 3 AFRAA airlines have a total of $88.9 million blocked in 12 African countries as of 2022.”

Other countries blocking funds for African Airlines include Algeria, Libya, Cameroon, The Central African Republic, Ethiopia, Eritrea, Equatorial Guinea, Guinea Conakry, Burundi, Malawi, Sierra Leone, Zambia and Zimbabwe.

According to the AFRAA Secretary General, Abdérahmane Berthe, unblocking funds for African airlines is critical for their financial stability and for maintaining uninterrupted operations.

“The longer these funds are held, the bigger the financial burden these states impose on airlines supporting air connectivity and economic activities in these countries,” Berthe was quoted in the report.