What next for Safaricom after M-PESA buyout?

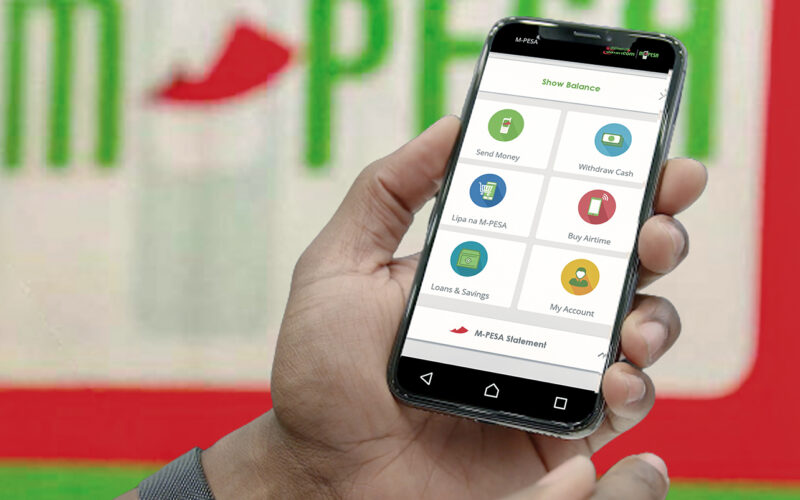

SAFARICOM PLC, Kenya’s largest telco, has fully acquired M-PESA Holdings Co. Limited, consolidating control of its mobile money service and cash cow, M-PESA. Its buyback of M-PESA from Vodafone's subsidiary Vodacom highlights its growth as a mature, independent African entity in the global telecommunications arena. In April 2020, Safaricom and South Africa's Vodacom completed the acquisition of the ubiquitous mobile money platform from Britain's Vodafone. Experts argue the new buyout, which was finalised on October 15, 2023, could mark a turning point in the company's push for profitability beyond its East African home turf. Safaricom will now have sway over…