[tta_listen_btn listen_text=”Audio” pause_text=”Pause” resume_text=”Resume” replay_text=”Replay”]

AFTER years of grappling with hyperinflation, Zimbabwe has taken bold steps towards stabilising its economy. In a major turnaround, the country cut inflation rates from over 300% in 2020 to 92% in February 2023.

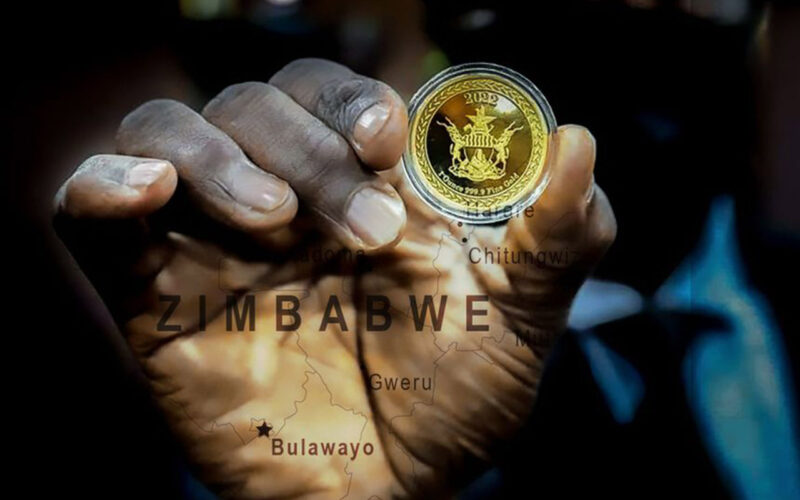

In an innovative, if drastic, step to scale down stubbornly high inflation numbers, the Reserve Bank of Zimbabwe has now introduced digital tokens backed by gold reserves to complement the national currency.

The digital tokens can be transferred between people and businesses as a form of payment and are projected to stabilise the Zimbabwean dollar.

According to Reserve Bank of Zimbabwe Governor John Mangudya, the digital tokens “can be used in person-to-person and person-to-business transactions and settlements.”

Some economists believe the new approach of using gold-backed digital tokens is not only a major innovation but could, in the long run, bear fruit.

Persistence Gwanyanya, a Reserve Bank of Zimbabwe’s Monetary Policy Committee member, acknowledges the need to address currency confidence issues dating back to 1997 and the hyperinflationary era of 2008 to achieve lasting success against inflation.

He explains that in Zimbabwe’s context, “no product other than gold can compete with the US dollar, especially as a store of value.”

“It is the reason RBZ’s Monetary Policy Committee has opted for gold instruments starting with physical gold coins and then the digitally backed tokens,” he explained.

However, according to Prosper Chitambara, a senior research officer at the independent think tank, Labour and Economics Development Research Institute of Zimbabwe (LEDRIZ), stabilising the Zimbabwean dollar may take more than a peg to gold.

“On the fiscal side the government has generally adopted an expansionary policy while we have seen a more conservative, hawkish monetary policy,” he noted.

“Ultimately, the impact has been that the fiscal policy has maintained dominance because of the expansionary thrust which in turn has led to an increase in money supply growth in local currency,” he said.

For instance, he explains that contractors paid by the government in local currency invade the market and end up offering to buy the US dollar at very high premiums to hedge against possible uncertainties.

“So my view is that the government has been between a rock and a hard place to maintain a balance between pressing infrastructure needs and maintaining the tight lid on inflation,” he concluded.

After Nigeria launched its e-Naira digital currency in 2021 and Ghana and South Africa began piloting their versions, several other African countries – including Namibia, Zambia, Madagascar, Eswatini, Mauritius, Tanzania, Rwanda, Kenya, and Uganda – are exploring the possibility of rolling out their digital currencies.

The digital tokens of Zimbabwe are unique, however, because they are backed by gold, which sets them apart from other countries.

Zimbabwe has battled inflation for years, with economic policies pushing it to record-breaking levels.

In July 2020, Zimbabwe’s annualised inflation leapt to 837.53 per cent, its highest level in five years. However, economic reforms such as the Foreign Exchange Auction and reducing the money supply showed promising results.

Inflation declined significantly, with the year-on-year inflation rate measured by the Consumer Price Index reducing to 348.59% by December 2020.

However, beginning in 2022, the country has switched gears to focus on gold as a currency stabilising tool – the Reserve Bank of Zimbabwe introduced gold coins as a legal tender in July 2022.

This is already bearing fruit, with Trading Economics recording inflation rates in Zimbabwe down at 75.2% in April 2023 from 87.6% in March – the tenth month in a row that they have dropped.

Past efforts to de-dollarize or boost the national currency have been met with scepticism given the extreme losses individuals suffered previously, after adopting the new offerings.

In 2009, a Government of National Unity helped Zimbabwe to ease inflationary pressures and shed its crisis-ridden reputation by adopting a purely US dollar-based system. However, realising the unsustainable costs of this system and the need to boost exports, the government began experimenting with alternatives in 2019.

The latest innovation, should it work, could turn Zimbabwe’s economy around and offer an economic growth opportunity for its population.