SETH ONYANGO, BIRD STORY AGENCY

MONTH-ON-MONTH growth figures show Africa’s startup ecosystem continues to receive a funding frenzy as investors flock to the continent’s sizzling tech space.

This comes as demand for tech solutions to power Africa’s fledging internet economy continues to grow.

With 1.8 billion US dollars already invested in the first three months of 2022, Africa: The Big Deal projects it will only be days until the 2 billion mark is reached.

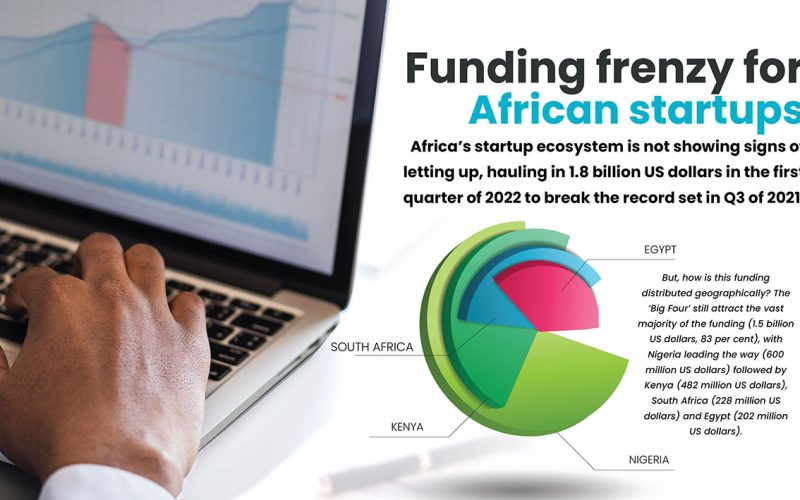

“Compared to last year, there’s been 2.5x more funding raised in Q1-22 than in Q1-21. But, how is this funding distributed geographically? The ‘Big Four’ still attract the vast majority of the funding (1.5 billion US dollars, 83 per cent), with Nigeria leading the way (600 million US dollars) followed by Kenya (482 million US dollars), South Africa (228 million US dollars) and Egypt (202 million US dollars),” Africa: The Big Deal figures show in part.

“The performance of Kenya is particularly impressive, as there’s already been more funding raised in 2022 there than in 2021 (412 million US dollars). If we look at YoY growth now (comparing Q1-22 to Q1-21), the best performer out of the Big Four is Egypt (x4.9 YoY), followed by Kenya (x3.7 YoY) and Nigeria (x2.3 YoY).”

South Africa, however, raised fewer funds in the quarter than in the first quarter of 2021, down16 percent year-on-year..

“But still, they have three more quarters to make up for it.” Africa: The Big Deal said.

Moreover, the figures showed an interesting phenomenon… growth outside of the well known African startup markets of Kenya, Nigeria, South Africa and Egypt, is on the rise.

“Finally, the best YoY performance really comes from outside of the ‘Big Four’ where Q1-22 funding has reached 306 million (x7.7 YoY), which is 50 per cent more than the funding raised there in Q1-19, Q1-20 and Q1-21 combined,” Africa: The Big Deal said via its Paystack newsletter service.

African startups’ 2022 performance does not come as a surprise –– the ecosystem raked in 1 billion US dollars in the first seven weeks of the year. That take was more than 25 percent of the entire 2021 amount – and came in just over 130 deals.

It took 46 weeks (nearly a year) in 2019 for African startups to reach the 1 billion US dollar mark, 36 weeks (9 months) in 2020, and 21 weeks (5 months) in 2021.

For 2022, the overall amount (over 4 billion US dollars in 2021) is projected to almost double.

Projections also show Africa could add more “unicorns” (companies with billion-dollar valuations) to its trophies shelf if its startup ecosystem maintains the impressive fund-raising trajectory it developed over the past year. There are several reasons to believe that it can:

Africa is now home to seven unicorns; Jumia, Interswitch, Flutterwave, Andela, Wave, OPay and Chipper Cash.

Five of these became unicorns in 2021 –– including two in September alone –– indicating levels of interest in Africa’s startup market not seen before.

With 2022 off to a good start, the continent could attract even more inward investment as investors look beyond the continent’s post-pandemic future and the positive news over this period helps sustain longer-term confidence in the region.

Meanwhile, the interest in fintech continues to grow, with fintech funding representing almost half (47 per cent) of the funding raised to date – roughly in line with overall 2021 numbers.