CONRAD ONYANGO, BIRD STORY AGENCY

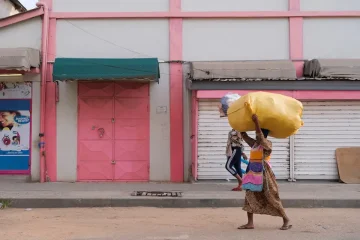

AS venture funding begins to slow down in markets outside Africa, a startup in the tiny Indian Ocean island nation, Seychelles raised millions of dollars from foreign investors – pushing its valuation to 10 billion US dollars and delivering Africa’s first ‘decacorn.’

Seychelles-based crypto exchange KuCoin is now the most valuable startup on the continent- with its current valuation exceeding the combined values of Chipper Cash and Opay (with valuations of over 2 billion US dollars each), Wave (1.7 billion US dollars), Andela (1.5 billion US dollars) and Flutterwave (1 billion US dollars).

While Seychelles does not feature in the latest edition of Startupblink’s global top 100 startup ecosystem rankings, there were a few signs of entrepreneurial stirrings in the Indian Ocean, if one knew where to look.

The country’s capital, Victoria recently improved its startup rankings by 99 places to 824 to finish in the top 1,000 cities list, moonlighting the rising investor attractiveness of the tiny island ecosystem.

“Victoria is an ideal place to locate for Fintech, Marketing and Sales and undefined startups,” according to Startup Blink.

In East Africa, Victoria edged up a slot to eighth most attractive ecosystem in the region.

In May, KuCoin raised 150 million US dollars in pre-Series B funding round, led by Jump Crypto, that catapulted the crypto exchange directly to “decacorn” (10x unicorn) value as a new unicorn in Africa. The exchange looks to pioneer web 3.0 – the next evolution of the World Wide Web.

It said the funds will be channelled to improving the platform’s trading system by enhancing security and risk management systems and incorporating global regulations.

“The new influx of capital will allow KuCoin to go beyond centralized trading services and expand its presence in Web 3.0, including crypto wallets, GameFi, DeFi, and NFT platforms through investment arms like KuCoin Labs and KuCoin Ventures,” said KuCoin in a statement.

Global venture funding dropped by 23 percent to 108.5 billion in the second quarter of 2022, the largest quarterly percentage drop in close to a decade. However, in value terms it was still the sixth-largest quarter for funding on record, according to CB insights’ State of Venture report Q2 2022.

And while key regions like the US (25 percent), Asia (25 percent) and Europe (13 percent) recorded drops, funding to Africa-based startups grew by 73 percent to 1.7 billion dollars compared to the amount raised in 2021.

“At the current rate, funding could exceed last year’s figure by 1 billion US dollars. If this occurs, this will be the second year of continuous and significant funding growth for the continent,” according to the venture report.

Out of the 85 new unicorns birthed over the quarter, Africa recorded only one delivery – KuCoin – but its valuation was the highest globally.

Elon Musk’s infrastructure and tunnel construction firm, Boring Company (5.7 billion US dollars) and Swiss open-source software development firm, SonarSource (4.7 billion US dollars) were the second and third most valuable unicorn births respectively, during the quarter.

The US and Europe accounted for most of the new unicorns, with 49 and 16 unicorn births, respectively.

Globally, the number of unicorn births fell by 43 percent from 148 in the second quarter of 2021 to 85 in the second quarter of 2022.