ZIMBABWE’s central bank governor says official remittances from the diaspora were up 45% during the January-September period from last year at $657.7 million as COVID-19 lockdowns forced people to send cash home via official channels.

Diaspora remittances are an important source of foreign exchange for the southern African country, which is in the grip of its worst economic crisis in more than a decade that has seen worsened dollar shortages.

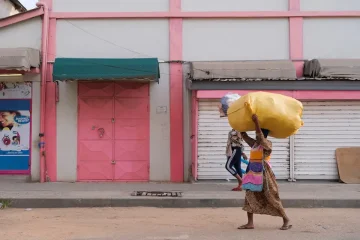

Most of Zimbabwe’s more than 2 million-strong diaspora live in South Africa, many of them illegally, and often send money via unofficial channels, including buses and trucks.

When Zimbabwe and South Africa closed their land borders as part of measures to contain the spread of coronavirus earlier this year, many Zimbabweans started to use money transfer agencies to send money to families back home.

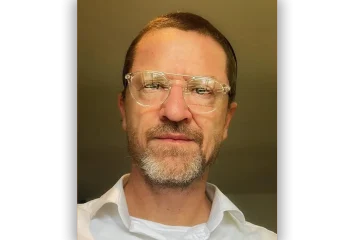

“What this means is that money is now coming through the formal system. Therefore it is also formalisation of the economy since COVID-19. This is fantastic news,” central bank governor John Mangudya told members of parliament in the capital Harare.

The diaspora remittances helped drive up foreign exchange inflows to $4.76 billion during the January-September period, up from $4.22 billion during the same period last year, said Mangudya.

Africa-focused money transfer firms have seen a boom despite predictions from the World Bank of a historic 20% drop to $445 billion in remittances to poorer countries this year due to the pandemic-induced economic slump worldwide.

At the same meeting in Harare, Finance Minister Mthuli Ncube reiterated that the economy was expected to grow by 7.4% in 2021 after contracting by 4.1% this year.

He had previously projected a 4.5% contraction this year. – Thomson Reuters Foundation.