bird NEWSROOM

AFRIC’S infrastructure sector has enjoyed the fastest year-on-year growth rate in a decade, according to a study released in April that focused on investment value and the distribution of projects across 54 African countries.

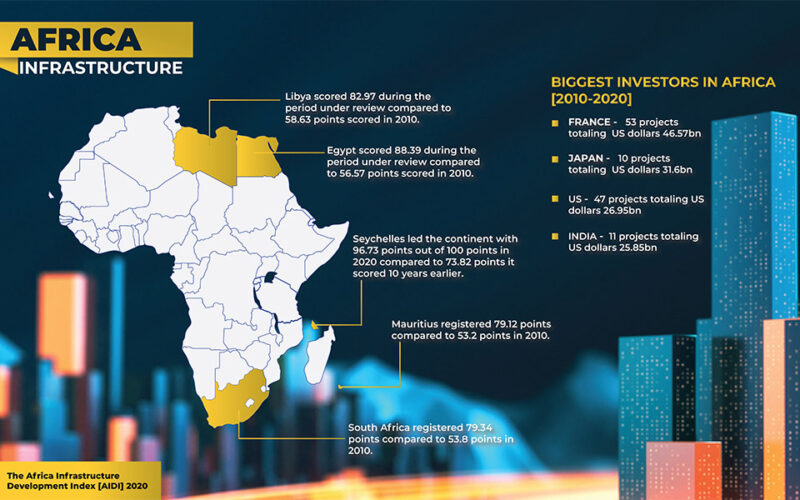

The Africa Infrastructure Development Index (AIDI) by the African Development Bank (AfDB) shows that Seychelles led the continent in terms of value for money with an impressive 96.73 points out of the possible 100 points in 2020, compared with the 73.82 points it scored 10 years earlier.

Egypt and Libya scored 88.39 and 82.97 points respectively during the period under review, compared with 56.57 points and 58.63 points scored in 2010, while South Africa and Mauritius came fourth and fifth, registering 79.34 points and 79.12 points respectively, against 53.8 and 53.2 points in 2010.

Undertaken in June 2020 and released in April 2021, the report’s findings are an indication of a growing economy with investors and African governments not sitting on their hands.

In fact, many governments are exploring substantial new projects, while some have already committed to major infrastructure build over the next decade, according to a McKinsey analysis. That research points to a considerable amount of infrastructure investment from government and private investors.

“investors are not sitting on their hands. Together with African governments, many of them are already exploring—or have committed to—major new infrastructure projects over the next decade. McKinsey analysis indicates that Africa’s current pipeline of infrastructure projects includes $2.5 trillion worth of projects estimated to be completed by 2025, across all asset classes,” the study reports.

The projects are in various asset classes including transport, electricity and ICT projects and although over 50 percent of them are still in feasibility stages, the figure represents an impressive source of future infrastructure activity.

Despite the imposing progress made in the last decade, experts point to a dire need of financial lift if the continent is to realise its maximum potential to grow the sector.

“Unfortunately, our research shows that most infrastructure projects in Africa fail to reach financial close: less than 10 percent of projects achieve this milestone, and 80 percent of projects fail at the feasibility and business-plan stage,” noted the McKinsey report titled Solving Africa’s Infrastructure Paradox.

Further, experts believe that accelerating Africa’s growth hinges on closing its vast infrastructure gap, which will require innovative financing and a mix of partnerships.

African economies continue to embrace innovative financing sources for infrastructure including local and foreign currency bonds, private equity, sovereign wealth funds among others with public-private partnerships also felt to be more attractive models between governments and moneyed private investors.

“Going forward, a mix of sources – and increasingly private and innovative ones –will be needed to close the infrastructure gap in Africa. There is no ‘one size fits all’ solution. The ‘right’ mix will depend on a number of factors, including financial development, indebtedness, the business environment and preferences in each country,” advises AfDB in its report.

Public-private partnerships (PPPs) have emerged as financial instruments for infrastructure investments in Africa due to their flexibility in nature.

PPPs are contractual arrangements that allow for private sector involvement in the supply of infrastructure assets and services and their modalities include management contract, leasing and investment. Seychelles Infrastructure and involves government and business that work together to complete a project and services to the population of the host country.

A report by the Infrastructure Consortium for Africa (ICA) done in 2018 found that between 2013 and 2017, the average annual funding for infrastructure development in Africa was 77 billion US dollars — double the annual average in the first six years of this century.

Nearly half of the recent activity was in West and East Africa, with 27 and 19 percent of the total respectively. Transport and energy sectors together accounted for nearly three-quarters of the total investment.

Africa recorded its highest level of project financing in a decade in 2020, in terms of investment value with 28 deals signed during the year, totalling 30.07 billion US dollars, reaching financial close, according to Linklaters. That research, shows that in the past decade, France has been the biggest investor in Africa, with 53 projects totalling 46.57 billion US dollars, followed by Japan (10, 31.6bn), the US (47, 26.95bn) and India (11, 25.85bn).