THE Democratic Republic of Congo (DRC) is on track to establish a new cobalt beneficiation facility in 2024, a facility which is expected to enhance the economic value of exported minerals, and boost revenue.

The Eurasian Resources Group (ERG) announced a groundbreaking deal with China’s BGRIMM Technology Group during the Third Belt and Road Forum for International Cooperation (BRF III) in Beijing, with an investment of US$250 million in the project.

ERG’s CEO, Benedikt Sobotka, emphasised the significance of this facility, describing it as “much needed for the critical mineral mining and processing industry and for the green energy transition.”

“It is very exciting to help increase the overall investment in cobalt beneficiation in the DRC. This will also lead to further improvement of infrastructure and bring many benefits for local communities in the country, which is a vital region for metals and mining and a key building block for the cobalt industry,” Sobotka added.

The Democratic Republic of Congo stands as the world’s largest cobalt producer, with an estimated production volume of 4 million tons in 2022, according to the German statistics platform, Statista. In a global context where cobalt reserves are projected to be around 8.3 million tons by the Cobalt Institute, the DRC’s cobalt reserves represent nearly half of the world’s total cobalt reserves.

Eurasian Resources Group manages the Metalkol RTR Project in the DRC’s Katanga region, which, according to GlobalData, is among the largest cobalt mines globally with mining volumes of more than 57,000 tons of cobalt in 2022.

Despite the critical role of cobalt in manufacturing batteries, jet engines, rare-earth permanent magnets, and more, the DRC primarily exports raw condensate, earning more than US$4 billion in export revenues in 2021.

Notably, this announcement comes at a time when mining companies in Africa’s key mining hubs are actively working to establish local mineral processing plants, responding to new requirements from various African governments.

From Ghana to Zimbabwe, Zambia to Tanzania, and even in Madagascar, there’s been a notable surge in local mineral processing plants aimed at enhancing the mineral value chain.

As Paul Chanda Kabuswe, Zambia’s Minister for Mines, put it, at the inaugural DRC-Africa Battery Metals Forum in September, “We must stop exporting soil.”

His words echoed a widely-shared sentiment among African mining countries.

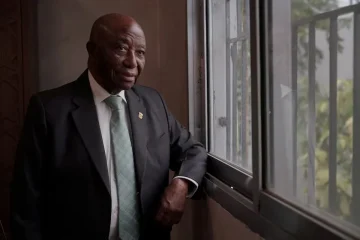

Duma Sisulu, co-founder of Parime Battery Minerals, which invests in early-stage battery mineral mining operations, told bird story agency that the high global demand for critical minerals and the necessity to increase supply to meet net-zero targets, made Africa increasingly important to mining and the mineral supply chain.

“The mining industry will require significant additional investment to bring new projects on-stream if the world is to successfully transition to a low carbon future,” he explains, echoing the International Energy Agency’s projection that the demand for rare earth metals will grow three to sevenfold by 2040.

Sisulu points out the need for global supply chain diversification, considering China’s dominance in the supply of lithium-ion and battery material production.

“Africa needs to build industries to process and refine its raw, critical minerals.” However, to achieve this, he outlines five key factors African countries need to address: capital, infrastructure, local demand, fiscal certainty, and research and development.

The current trend of establishing local mineral beneficiation facilities offers the potential to bridge existing gaps and possibly unlock most of these factors, Sisulu explained.

“Infrastructure such as roads, rail, ports, and electricity are essential for manufacturing. This includes developing EV infrastructure to support the development of local demand for EVs,” the Parime co-founder said.

Signs of renewed interest and commitments from Europe and beyond are evident, as highlighted at the Global Gateway Forum in Brussels.

The two-day summit (held between October 25 and 26) saw the EU sign strategic partnerships for critical raw material value chains in the DRC and Zambia, with a focus on the development of the Lobito transport corridor.

According to a statement revealing the new commitments, Jutta Urpilainen, the EU’s Commissioner for International Partnerships, explains that the new partnership involves support that will see the successful development of the Lobito transport corridor.

“The Lobito transport corridor will be a game changer to boost regional and global trade,” she states.

This commitment follows the recent collaboration between the EU and the US to support the establishment of a new rail line from Angola to Zambia, a vital part of the Lobito Corridor connecting the DRC, Zambia, and Angola’s port of Lobito.

As Sisulu highlighted, there is also the need to increase local demand for EVs and Lithium-ion batteries, which will attract cell manufacturing capacity to the continent.

“This can be achieved through policies that drive the adoption of EVs, such as zero-emissions vehicle subsidies and emissions regulations,” he shared.

This is especially relevant considering the 2023 Africa e-mobility readiness index tool jointly developed by the Africa e-mobility alliance and UNEP puts the continent’s EV readiness index at 33% despite country-level variations.

Useful Links:

https://ec.europa.eu/commission/presscorner/detail/en/ip_23_5303

https://www.ergafrica.com/wp-content/uploads/Media-Release-BRI-Forum_ERG-to-build-a-high-quality-cobalt-beneficiation-facility-in-the-DRC-signs-EPC-contract-with-Chinas-BGRIMM.pdf

https://www.bird.africanofilter.org/stories/a-surge-in-local-processing-investments-redefines-africa-s-mining-sector